Q1 SME Pulse Survey

A quarterly snapshot of the SME lending market

Help us build an outstanding bank for our business customers with our SME Pulse Survey

Our SME Pulse Survey is a quarterly survey that we send out to our commercial broker panel with the aim of capturing a snapshot of the SME lending market.

The result is a crowd-sourced, expert insight into what matters to small business owners, from understanding their concerns to getting a better idea about the reasons they borrow, and everything in between.

These results will be incredibly useful for us as we look to improve our offering, but we hope to our commercial brokers who work with these businesses too.

Why have we launched the SME Pulse Survey?

We know the knowledge of our broker panel is our best resource when it comes to understanding the SME lending market.

That’s why we have launched our SME Pulse Survey, a quarterly survey, providing you with the opportunity to share your views on the market with us.

We’ll use the insight gained from the survey to improve our bank in ways that will benefit both you, the broker, and the businesses we lend to. We’ll also aim to track emerging patterns in the sector over time and share those with you.

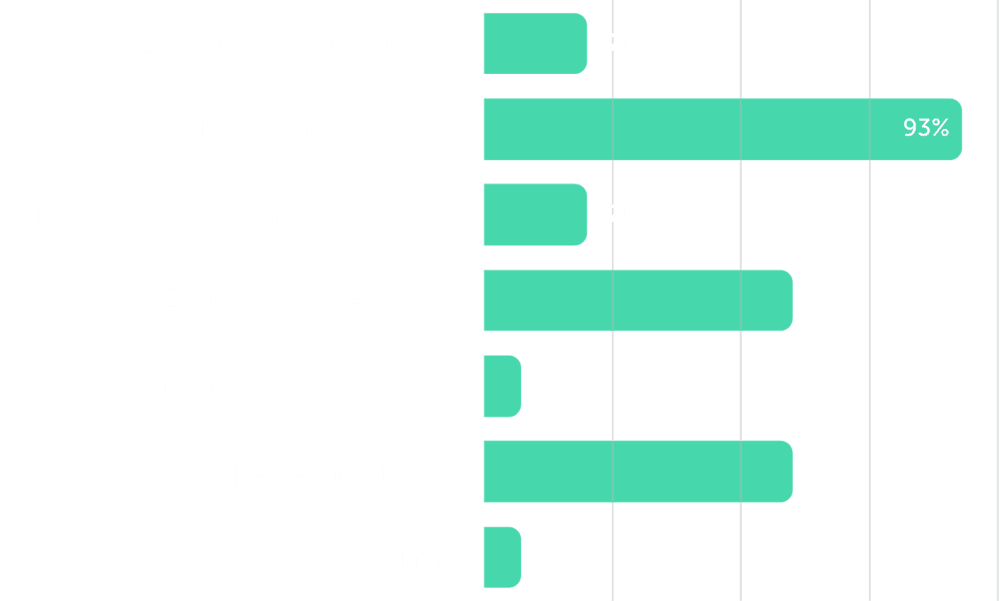

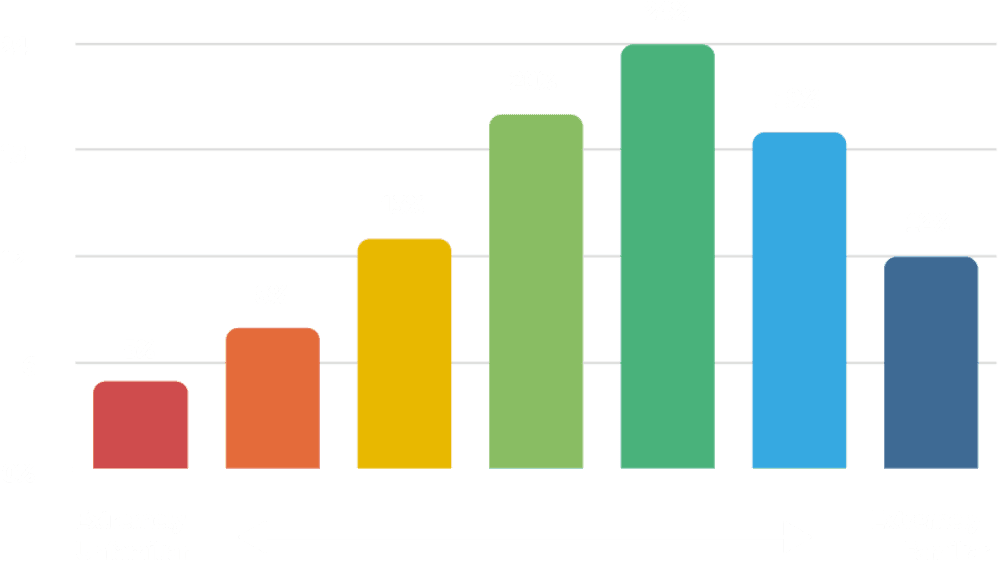

THE HEADLINES FOR Q1

62%

Nearly two-thirds of brokers see a rising appetite from SMEs for external funding, up 17% from our last Pulse of 2023

55%

Lower interest rates are driving this increased appetite, brokers reported, ahead of business confidence

49%

Property purchase is now the most common purpose for taking out a loan, with a significant rise on our Q4 Pulse (34%)

73%

The vast majority of commercial brokers expect property investors to take advantage of the market bottoming out this year

73%

Three quarters of brokers said they did not expect clients to take a 'wait and see' approach ahead of this years General Election

David Castling

Head of Intermediary Distribution

“2023 was undoubtedly a difficult one for commercial borrowers, but our latest Pulse survey shows that attitudes are changing, with SMEs recognising the chance to take advantage of lower interest rates than were available last year.

That property purchase has become a more common driver for SME borrowing is a reflection not only of the borrowing costs, but also the pricing of commercial premises, which have taken a hit in recent times. There are increasing opportunities for businesses to secure the perfect home for years to come, and at an attractive price.

Despite the general positivity among brokers, it's notable that one in four SMEs still experience difficulties in accessing the funding they require. Small businesses are hugely important to the economy, but they can only thrive if they can raise funds when necessary. That is why it's so crucial for brokers to work with lenders who are genuinely committed to this sector, with the products and processes in place to provide swift funds and certainty to SME borrowers.”

Want to grab a copy?

Download the Q1 2024 SME pulse survey

Access results from previous quarters here:

Q4 2023 SME pulse survey

Download the PDFQ3 2023 SME pulse survey

Download the PDFQ2 2023 SME pulse survey

Download the PDFWhat’s next?

We’ll be conducting the survey on a quarterly basis and sharing the results as we do. That means you can provide your views and then get access to regular and relevant insights into the SME lending market.

We’re using the outputs from the survey to create a list of actionable improvements we’d like to make to our technology and processes. So, watch this space for new products, services and features based on the information we’ve gained.

We’re currently preparing the next survey, so keep an eye on your inbox if you want to get involved and be in with a chance of winning a £250 Amazon voucher!