Atom and BBVA in strategic partnership

24 November 2015

World’s Leading Digital Bank Joins Existing Shareholders to Complete Atom’s £85M Primary Capital Raise

Atom the UK’s first digital bank is delighted and excited to announce its strategic partnership with BBVA. BBVA has agreed to invest £45m for a 29.5% stake in Atom and bring their global expertise in digital and mobile banking to the launch and growth of Atom.

In addition to their pioneering use of technology across a global banking group that spans the Americasd Europe and Asiad BBVA runs one of the world’s leading innovation programmes in the banking and fintech industry from their innovation centre in Madrid. In 2014, BBVA purchased Oregon based Simple, a tech company that is changing the way people bank and think about money in the US. In Addition, the $100 million BBVA Ventures fund has invested in leading fintech businesses, proving that values-driven banking and cutting-edge fintech are natural allies in the delivery of better value and control for both personal and business customers.

Mark Mullen, Atom’s CEO, described what the partnership and the closing of the capital raise means for Atom. “We have long admired BBVA’s vision and leadership. Like us, BBVA firmly believe in the power of technology to transform customer’s lives for the better. We share their commitment to place the interests of customers at the heart of everything that the bank does, and the shared values and relationship between us that has built up over months of interaction have been critical to knowing that they are THE strategic partner for Atom. It is a huge vote of confidence in our team, business model and indeed the future of competition in UK banking that BBVA are coming on this journey with us.”

Commenting on the successful close of Atom’s capital raise, founder and Chairman Anthony Thomson said: “Atom has now raised over £135m in the 18 months since the founding team came together. This is a great response from investors to the compelling business case that the team has put together, and is a powerful signal to the regulators and most importantly for UK consumers. We have kept our app to ourselves so far to protect the innovation and IP that it is built on. Having seen it in operation I believe it will transform banking in the UK and beyond and with BBVA as our strategic partner we really do feel that the sky is the limit for Atom.”

“BBVA believes the UK offers excellent growth opportunities and that digital banks that put the customer first are the future,” said Francisco Gonzálezd BBVA’s Chairman and Chief Executive. “BBVA’s investment in Atom backs those beliefs in one move”.

Existing core investors Woodford and Toscafund have maintained their positions as leading shareholders and well-known institutional investors Marathon and Polar Capital are also maintaining their commitment to Atom as part of this final raise before launch.

Atom is already in a live trial and will move shortly to an invitation Beta before a public launch in early 2016.

Atom’s capital raise has enjoyed the advice of Canaccord Genuity and Atom has been supported throughout by Bond Dickinson LLP

ENDS

About Atom bank

Atom is a start-up bank, not yet launched, but recently authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA.

Founded over a year ago and based in the City of Durham, Atom has a growing team of 160 people drawn from across the country, working with partners to bring pioneering technology to Europe for the first time. Atom is building the UK’s first bank designed specifically for digital, offering easy and convenient banking, along with unique and engaging ways to manage money.

The Atom executive team are highly experienced, having built and run some of the most well respected banks in the UK. CEO Mark Mullen has 25 years experience in the sector and was previously CEO at the multi-award winning telephone and internet bank first direct.

The team are supported by a strong non-exec board, which includes founder and Chairman Anthony Thomson, also the founder and former Chairman at Metro Bank. He is Chairman of the Financial Services Forum, the UK’s leading membership organisation for senior FS industry executives and Chairman of the National Skills Academy for Financial Services, a national charity.

The investment requires satisfactory completion of the Bank of England’s controller process. For more information visit atombank.co.uk. Full details of the extent of our authorisation by the PRA can be found on the Financial Services Register.

About BBVA

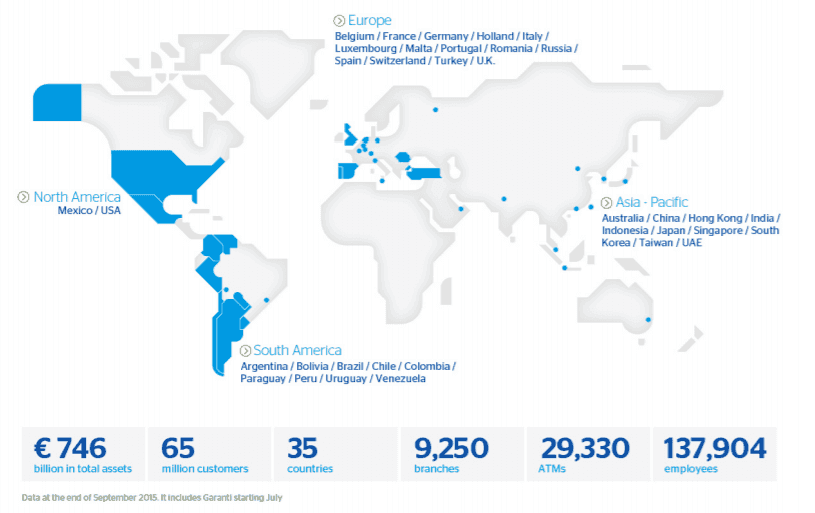

BBVA is a customer-centric global financial services group founded in 1857. The Group is the largest financial institution in Spain and Mexico and it has leading franchises in South America and the Sunbelt Region of the United States; and it is also the leading shareholder in Garanti, Turkey’s biggest bank for market capitalization. Its diversified business is focused on high-growth markets and it relies on technology as a key sustainable competitive advantage. Corporate responsibility is at the core of its business model. BBVA fosters financial education and inclusion, and supports scientific research and culture. It operates with the highest integrity, a long-term vision and applies the best practices. The Group is present in the main sustainability indexes.

Data at the end of September 2015. It includes Garanti starting July