Frequently Asked Questions

We’re a very open bank, so whenever you ask us a question we’ll try our best to answer it (ideally it’ll be about banking though). Simply browse the FAQ topics below to find your answer, and if it’s not listed here, get in touch.

All about Atom

Is Atom a real bank?

Yes, we are! We’re a licensed bank that is authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and PRA.

We’re also covered by the Financial Services Compensation Scheme (FSCS) so any savings with us are covered by up to £85,000 — you can find more information here.

We are an app-based bank, so we don’t have any branches, which is why you won’t have come across us on your local high street.

Whether you want to make the most of your savings, apply for a mortgage or take out a loan for your business, we provide simple products that will deliver ease, speed and value right to your device.

Want to hear more? Visit our About Us page to see what we’re all about.

What career opportunities do you have?

We’re the UK’s first app-based bank. We’re taking on the establishment and you can be a part of our journey.

If you want to join one of the UK’s most innovative fintechs, working on the latest tech and be part of one of the top 20 places to work in the North East, then take a look at www.atombank.co.uk/careers/.

What is Atom?

Atom is a bank that’s all about you.

Welcome to the UK’s first bank built for mobile that’s taking on the establishment. App-based, customer first, here to make things better for you.

Simply, we’re here to do the right thing by our customers. To stand up against the big banks, to save customers time, offer the best products we can and help you take control of your finances.

And we’ve got a whole bunch of products to help you do just this. Explore our range to discover our Fixed Saver, Saver Reward and Instant Saver accounts, our mortgage products and our commercial mortgages for SMEs.

We’re entirely app-based, so we don’t have any physical branches. This means we save money, so we can pass these savings on to you through our rates.

As one of the UK’s most innovative fintechs, there’s a lot more coming from us – we’re well on our way to creating the most customer-centric bank on the planet.

Where are you based?

Wherever is most convenient for you. At home, on the train, in the queue at the supermarket…wherever your smartphone or tablet is, we’re there too. Physically, our HQ is in Durham, and we have a small London office too.

Where’s my nearest branch?

We’re branch-free and proud of it. Because we don’t have branches, we can keep our overheads down and pass the savings on to you with really competitive rates. You simply do all your banking on your smartphone or tablet.

But don’t worry, we’re always here to talk. You can catch our Customer Support Team 7 days a week, 8am - 8pm, on email, app chat, social media or phone.

Who owns Atom?

Atom is a privately-owned company with a broad range of shareholders, including BBVA and Toscafund Asset Management. To find out more, visit our investors page.

Banking basics

What is the Personal Savings Allowance (PSA)?

Your PSA sets out the amount of interest you can earn in a tax year without having to pay tax on it. Your allowance depends on your individual circumstances and is influenced by things like your income tax band. You’ll find more information here https://www.gov.uk/apply-tax-free-interest-on-savings

What does ‘AER’ mean?

‘AER’ means ‘annual equivalent rate’ and is designed to make it easy for you to compare savings products. It tells you how much interest you’d earn if you put some money in an account and left it there for a full year. It takes account of things like how often the interest is paid and assumes any interest paid during that year is added to the balance and earns interest.

What does ‘gross’ mean?

‘Gross’ is the rate of interest that’s payable on the account and represents the amount of tax-free interest you’ll earn in a year.

Is there a difference between instant access and easy-access savings accounts?

Not really. Both of these terms describe accounts that give you instant, unlimited access to your money.

You may have heard the term ‘easy-access savings’ used to describe similar products, but it generally means the same thing as instant access.

Many banks choose to describe their products as one term or the other, and there may be some slight differences from bank to bank. But the feature they all should have in common is providing instant, unlimited access to your funds.

Here at Atom, our Instant Saver and Instant Saver Reward accounts are both easy access accounts.

Opening an account

Can I open an account by post or through the website?

Afraid not. We’re an app-based bank, and you can only open an account with us through your smartphone or tablet.

Can I open an account if I don’t live in the UK?

Unfortunately not. You can only become a customer if you’re a UK resident. If you’re going to reside overseas temporarily, you must let us know as you may have difficulties using and updating our app. If you’re going for 3 years or longer, we’ll need you to close your account.

How can I help to verify my postal address?

This might have something to do with it’s format. To double-check the format is okay, go to the Royal Mail website and put in your postcode. The website will show your address correctly. Simply copy it when you log in.

How do I get a mortgage?

You’ll find more info about our mortgages on our Mortgages page, where you can also search for a broker.

Our mortgages are available through brokers. A broker will make sure that you get a mortgage product that’s right for you, even if that’s not with us. You can find a broker here.

How do I join Atom bank?

Interested in joining a bank that’s built around you? Of course you are. All you have to do is download the app.

How do I open a Fixed Saver account?

You’ll find more info about opening a Fixed Saver account on the Fixed Saver page or you can follow the steps below.

If you’re a new customer, you’ll need to download the Atom app to your mobile or tablet. Once it’s installed, tap on ‘New customer, get started’, view the content about Atom and then browse our Fixed Saver products. Select the product you’d like, read the details and tap Apply.

If you’re an existing customer, log into your app on your mobile or tablet. Tap the menu and select Browse products. Select the product you’d like, read the details and tap Apply.

How old do I have to be to open an account?

At least 18 years old.

What documents do I need?

When you apply for an account you don’t need any paper documents. We just verify your identity electronically through the app. On the odd occasion that we do need more info, we always try and keep it to an absolute minimum.

What is a connected account?

This is the account that you can use to send money to and from your Instant Saver and Saver Reward. It must be a UK personal current account, in your name and registered at your address (it cannot be a business current account).

Why can’t I set up my connected account?

Your connected account has to be a UK personal current account that’s in your name and registered to your address. If you’re having issues adding a connected account, please get in touch with our Customer Support team on 0333 399 0050.

Why do you need my bank details?

When you apply to become a customer, we’ll ask you for some personal details so we can verify your identity. The exact details we’ll need will vary depending on what you’re applying for, but will always include information like your full name, address and date of birth.

To complete the identification and verification (‘ID&V’) process, we’ll run an identity search with a credit reference agency. If you apply for a savings product, this will leave a ‘soft footprint’ on your credit file, so won’t affect your credit history. If you apply for a mortgage, it’ll leave a ‘credit footprint’ on your file which means other providers will be able to see that we’ve run a search.

There are times when we may ask you to complete ID&V again (to keep our records up to date if you move house, for example).

Will I get a bank card?

No, your account is managed through the Atom app. It’s a savings product and is not intended to be used for transactions or bills.

Why do I have to use a connected account with my Instant Saver and Saver Reward account?

The connected account feature and Confirmation of Payee (CoP) process help to protect you against fraud, keeping your money as safe as possible. It also means it’s really easy to make deposits, or withdraw money, whenever you want.

Managing your account

Can I access my account on multiple devices?

Yep — just download the app on your other devices and tap ‘Add a Device’. We’ll email you a unique log-in code to use, then we’ll verify your identity and you’re in.

Can I add a third party to help me with my account?

We may be able to add a named third party to your account.

The nominated individual should be someone you trust, as we will provide them with your account information. Please note: your trusted nominee won’t be able to conduct any actions on your account or access the app.

Please call us on 0333 399 0050 to discuss setting up a nominated third party.

Can I delete my customer record and associated data?

Yes, you can request that your customer record and any associated data is deleted where there are no additional legal and/or regulatory requirements for us to keep it.

To submit a request, please contact our Customer Support team via email at customersupport@atombank.co.uk.

You can find a full explanation of your data and your rights in our Privacy Policy.

Can I opt out of Confirmation of Payee?

You can’t opt out of Confirmation of Payee (CoP) when you’re making a payment to someone else. But, depending on the circumstances, you can opt out of a payer checking your details before they make a payment to you.

As one of our customers, you are automatically opted into the CoP scheme. This means that any account you move money to or from will be verified to make sure your funds are going to the right place. You will also benefit from the protection the scheme offers against bank transfer scams. We are required to automatically opt you in because CoP works best when banks (and their customers) are all working on the same page.

In some situations, it is possible to opt out of the CoP scheme. You can’t opt out when you are making payment to someone else, but you may be able to when a payer checks your details when making a payment to you. We will assess any opt out requests on a case by case basis. To do so, you can contact our Customer Support team by phoning 0333 399 0050 (8am to 8pm, 7 days a week). We will then get back to you via email within 5 working days with a decision.

If your request is approved, we will opt you out of any further CoP checks being performed on your account(s). If you change your mind, you can get back in touch with our Customer Support team and request to opt back in.

Can a power of attorney be set up on an Atom account?

If a power of attorney needs to be registered with us to allow someone else to be able to operate an Atom account(s), please call our Customer Support team on 0333 399 0050 to discuss.

Note: we can’t arrange this through our app chat for security reasons.

Once set up, an attorney will be able to access information about the donor’s account and, in some circumstances, we may restrict what the donor is able to do.

How can I let you know if I need additional support?

It’s now easier than ever to let us know when you need extra support. If you have a vulnerability, illness, condition or have experienced a change in circumstances, you can tell us about it within the app by following these steps:

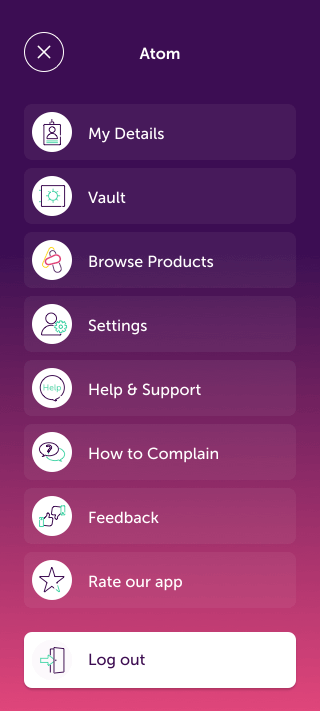

- Go into the main menu (click the three lines at the top left of the main app screen)

- Click ‘My Details’

- Select ‘Additional support’ and choose the circumstance that best describes your situation

Additional support covers, but is not exclusive to:

Accessibility*:

- Blindness or visual impairment

- Deaf or hearing impairment

- Speech impediment

- Mobility, dexterity or accessibility need

- Cognitive impairment

- Low literacy skills

- Low numeracy skills

- Find it hard to use technology

- Find it hard to speak or understand English

- Don’t have access to or find it difficult to get support

Life Events*:

- Bereavement of someone close

- Laid off from a job or income has reduced

- Going through relationship difficulties

- Victim of domestic abuse

- Caring responsibilities

- Struggling financially

- Have an addiction

- Severe or long-term illness

- Mental health condition

- Find it challenging to manage finances

Any circumstances not covered above can be logged under ‘my circumstance isn’t listed’, and supporting notes can be added.

*All information stored is in line with Atom’s Privacy Policy.

Alternatively, you can contact our customer support centre via the app, email customersupport@atombank.co.uk, or call us on 0333 399 0050 to discuss your circumstances and how we can help.

How do I add or change a connected account?

You can add or change your connected account in the app. Check out this video to see the process in full and follow the simple steps. Remember, you can only connect one account to your Instant Saver or Saver Reward at any time.

How safe are my details and money?

Safe – visit our Security page.

What happens when an account holder dies?

When a loved one dies, dealing with their finances is probably the last of your worries. We do everything we can to make the process as stress-free as possible.

When you get in touch, we’ll ask you to send us a certified copy of the death certificate. If you’re not a customer, we’ll need to check your ID, your passport or driving licence will be ideal. If possible, please have account numbers to hand when you call us, as this will allow us to trace the accounts and get things started for you quickly.

If you have any further questions about our bereavement process, simply call us. Lines are open 8am - 8pm.

What happens when my account matures?

We’ll let you know as your Fixed Saver nears maturity via push notification. Once you are three days out, we’ll send you a push notification and an email, then you’ll be able to choose what you want to do via our app.

You have a few options:

Subject to availability, you can choose from the following options:

- Save it all into a new or existing Instant Saver and access it anytime you like.

- Move some of it into a new or existing Instant Saver to access any time you like, and withdraw the rest to an external account.

- Save it all into a new Fixed Saver.

- Move some of it into a new Fixed Saver and withdraw the rest to an external account.

- Withdraw it all to an external account.

Sometimes late to the party? If you miss your three-day window to give us instructions, we’ll automatically move your funds to your Instant Saver (if you have one), otherwise your money will be sent to a Holding Account.

Should your money end up in a Holding Account, you can choose to withdraw it, reinvest it into a new Fixed or Instant Saver, or split between reinvesting and withdrawing at any time. We encourage you to move your money out of a Holding Account quickly as they have a lower interest rate, which means your savings will not be working as hard as they can.

What information should I enter in a Confirmation of Payee request?

Lots of banks use a name verification service called Confirmation of Payee (CoP) to verify that the payee details you are sending funds to are correct and secure. Before you send funds to your Atom savings account, your bank may ask you for the account number, sort code and account name (payee name) of your Atom Savings Account. Be sure to use your name (e.g. Mrs Jane Smith) as the account name (payee name) and mark the request as a personal account, if asked.

What is Confirmation of Payee?

Confirmation of Payee (CoP) is an account name checking service which helps protect against fraud, by making sure payments are sent to the correct bank account.

Why can’t my bank verify the details of my Atom account?

To provide you with greater confidence and to ensure security when moving money, we use the Confirmation of Payee (CoP) scheme, which allows account details to be checked between banks. Launched in the UK in 2020, it lets a payer verify a payee’s account before making a payment to confirm that the funds are being moved to the right place. It also plays a big part in reducing instances of bank transfer scams.

Previously, we were a CoP Requester, which meant we could only request account verification from other banks. However, we are now also a CoP Responder, so we can verify the details of your account when requested by other institutions. This should make it much easier for your bank to request and receive the right confirmation, as well as giving you greater confidence that any payments made into one of your Atom accounts will end up in the right place.

As a CoP Responder, we can provide other institutions with verification of your Atom bank account.

Please note: If you submit a CoP request for payment from an account that is not the connected account for your Atom Instant Saver or Saver Reward, CoP will complete a check if the payee details are correct as usual. However, as you cannot make a payment into your Instant Saver or Saver Reward from an unconnected account, our system would reject the transaction.

As CoP checks the details of the accounts only, you might get an initial success message as they match, which can cause confusion when the transaction is rejected. To complete the transfer, you will need to move the funds from your connected account.

Why do I need to add an additional reference when I link an external account to my Fixed Saver?

Some account providers require an extra reference to identify their customers’ accounts for added security, known as Secondary Reference Data. You’ll be familiar with this if you have a bank or building society account that has a roll number, or have a mortgage account with a reference number. The reference is usually up to 18 characters long.

When you link an external account to your Fixed Saver, we may ask you to provide this additional reference, alongside your sort code, account number and account name.

We’ll only ask you to provide this reference if we identify that your external account requires it to link the account.

If you aren’t sure what your reference is, please contact your account provider or use another account.

The app

Do I have to use Face and Voice?

Yes, to use the Atom bank app you will have to register your Face and Voice biometrics, as well as a Passcode.

Once your Atom bank Face and Voice biometrics are registered, you can choose how you want to log in to the app:

- With your device security, such as Touch ID*, Face ID* or Android Fingerprint

- Using your in-app biometrics (Face and Voice)

- Using your in-app Passcode

For some actions, we will ask for an additional layer of security via your in-app biometrics or Passcode, even if you choose to log in via your device security.

*Touch ID and Face ID are registered trademarks of Apple Inc.

How do I add a device?

Just download the app on your other devices and tap ‘Add a Device’. We’ll email you a unique log-in code to use, then we’ll verify your identity and you’re in. Check out this video to see the process in full.

How do I reset my Passcode?

You can reset your Passcode in our app by following these steps:

- Access the menu (click on the three lines in the top left corner of the main screen), select ‘Settings’, and then ‘Security’. Click on ‘Passcode’ under the ‘Atom Security’ section.

- You’ll then be able to request a security code to be sent via text message to confirm your identity.

- Once you’ve entered this, you’ll be able to update your Passcode by following the prompts.

- We’ll confirm this with another text message and an email — you’re good to go!

How do I update my Atom Face and Voice in-app biometrics?

If you need to update your Atom Face or Voice in-app biometrics, you’ll need to get in touch with our team on 0333 399 0050 and we’ll be able to reset them.

Can I use the app on more than one device?

Once you’ve completed registration and security, you can download the app on your other devices and tap ‘Existing Customer’ followed by ‘Add a Device’. We’ll email you a unique log-in code to use, then we’ll verify your identity and you’re in.

How do I find what version of the app I am using?

This info is found in Support Information, here’s how to get there:

Log into your app, go to menu and tap Help & Support. Then tap Support Information - you’ll find the version number listed there.

How do I log in to the app?

When you open the app, you will have several options to log in with:

-

Using your Atom in-app biometrics (Face and Voice) — you’re required to set these up when you first open an Atom bank account.

-

Using your Atom Passcode — you’re required to set this up when you first open an Atom bank account.

-

Using device security — once you’ve logged in for the first time with the above options, you can go to Settings and enable any device security you have switched on, such as Touch ID*, Face ID* or Android Fingerprint. This will allow you to log in with this method the next time you open the app.

*Touch ID and Face ID are registered trademarks of Apple Inc.

How do I log out?

From your hub screen, simply tap on the menu. Then press Log out.

How do I manually update apps on my mobile or tablet?

The simplest way to find out if an update is available is to search for the app in the App Store or Google Play Store. If an update is available, you’ll see a button that says ‘Update’ - tap this and the latest version will be downloaded.

Which devices can use the app?

We try to support as many devices as possible but as with many other apps, some are too old for us to support.

For both iOS and Android, our app will support the latest version of your operating system, as well as the two preceding versions. Whilst our app may continue to work on older operating systems, we won’t officially support it and it may stop working. It’s your responsibility to ensure you’re using a device compatible with these operating systems for the entire term of any products you have with us.

To check which operating system your device uses: For Android: go to ‘Settings’ then ‘About Phone’. The operating system will be listed here. For iOS: go to ‘Settings’ then navigate to ‘General’ and then ‘About’. The operating system will be listed under ‘Version’.

Why don’t you support every single device?

We’d love to, but there are many different types of mobiles and tablets with so many operating systems that we can’t test them all. We trial our app on the most popular mobiles and tablets so we can make sure you get the best banking experience possible.

Will my tablet work with your app?

We try to support as many devices as possible, but as with many other apps, some may not be compatible, especially if they are getting a little old.

For both iOS and Android, our app will support the latest version of your operating system, as well as the two preceding versions.

To check which operating system your device uses: For Android: go to ‘Settings’ then ‘About Tablet’. The operating system will be listed here. For iOS: go to ‘Settings’ then navigate to ‘General’ and then ‘About’. The operating system will be listed under ‘Version’.

Can I change my email address and/or phone number within the app?

Yes, you can change both your email address and phone number within the app. When in the app, go into the menu and select ‘My Details’, and then head into ‘Contact information’, click on the pencil next to either the email address and mobile number, depending on what you want to change. You will then be prompted to follow a number of security instructions to register the new details.

What is the ‘Android app hibernation’?

From November 2022, Android OS will introduce app hibernation for devices that are running OS 12 or higher. This feature will automatically remove temporary files and stop any notifications for apps that you haven’t used in the previous 90 days — effectively silencing any apps that you don’t use regularly.

This will affect those who have an Atom bank savings and/or mortgage account, but are infrequent or inactive users of the app on Android devices.

How will the Android app hibernation affect my Atom bank app?

This new feature may impact your Atom bank app if you don’t log in for 90 days. This may be an issue if you have products with us that don’t always need regular attention, such as a Fixed Saver or mortgage.

If our app goes into hibernation after 90 days, we won’t be able to share key updates about your accounts or regulatory information through push notifications.

Please rest assured that we’re taking steps to make sure that you’ll still get all of your key updates by email, so you won’t be missing out.

Can I disable the Android app hibernation feature?

Yes, it is possible to turn off this feature for the Atom bank app.

The following steps should work on most Android devices:

- Open Settings on your device (the cog icon)

- Go to “Apps”

- Tap “See all apps”

- Find the Atom bank app in the list

- Disable either “Pause app activity if unused” (Android 13) or “Remove permissions and free up space” (Android 12)

This will switch off Android’s app hibernation feature so you should be able to continue using the Atom bank app at your own pace without missing any notifications.

Can’t follow the above steps exactly? Some manufacturers (such as Samsung or Xiaomi) have a different method of managing your options. Please check with your device’s manufacturer guidance for their own instructions.

What is device security?

Your device security means the various log in features that you can use to unlock and access your device, such as iOS Face ID*, iOS Touch ID* or Android Fingerprint. You can also use these to access secure apps, including the Atom bank app.

*Touch ID and Face ID are registered trademarks of Apple Inc.

How do I enable device security in the Atom app?

You can enable your device security at any time by heading to Settings > Security and then using the toggle switch to turn on your chosen method.

Please note: Our Customer Support team isn’t able to enable or disable your device security for you. However, if you get stuck, they will be able to talk you through switching it on in our app once you have it set up on your device.

How do I set up device security on my device?

You need to set up your device security through your device settings before you can enable it on the Atom bank app. The way to do this can vary depending on your device, so please refer to your manufacturer’s instructions.

Please note: If you contact our Customer Support, they will only be able to help you switch on device security in the Atom app once you’ve set it up on your device.

Can I still use Atom’s in-app biometrics or Passcode to log in?

Yes, you can still choose to log in via your Atom in-app Face, Voice or Passcode. If you don’t enable device security, this will continue to be the default way to access the app.

If you enable device security, it will then become your default login method, though some devices may provide the option to cancel and revert to Atom in-app security should you wish.

For some actions, we will ask for an additional layer of security via your in-app biometrics or Passcode, even if you choose to log in with your device security.

How do I switch off device security?

You can switch off your device security at any time by heading to Settings > Security in your Atom bank app and then using the toggle switch to turn it off.

If my device security doesn’t work, can I still log in?

If you have device security switched on but it doesn’t work to get you logged in, you’ll then be asked to log in with either your Atom in-app biometrics (Face or Voice) or Passcode.

If I enable my device security, will others be able to access my app via other registered devices?

If you choose to switch on device security in our app, anyone who has registered their own security credentials on your device will be able to log in to the Atom app. This might be because you share a device with someone and you both need to access it.

They’ll then have access to information about your accounts and will be able to carry out certain activities, like withdrawing money from an Instant Saver to a saved connected account. Please consider this when deciding whether to enable this feature.

Why can I no longer access the app?

There are a few reasons why you might not be able to access the app:

-

The operating system (OS) you’re using isn’t supported by our app.

For iOS, we only support the latest version of the operating system, as well as the two preceding versions. If your OS is older than this, our app may not be accessible.

Please update your operating system to the latest version (or one of the previous two versions) or install the app on a device running one of these versions.

-

You need to download the latest version of our app.

Sometimes, we need to make sure that your app is up to date — for example if a vital bug fix or security update is required. So, we may stop you from accessing the app until you download the latest version of the app.

Head over to the App Store or Google Play Store to update the app. This will replace your app with the latest version and you should be able to access it once again.

-

Our app is undergoing maintenance or there is an outage.

Occasionally, we need to undertake routine maintenance to make sure our app is running nice and smoothly. And, once in a while, we may have found an issue that causes some outage while we fix it.

We’ll usually let you know if this is the case when you start up the app.

How do I check what version my operating system is (iOS)?

To view your current version of iOS, navigate to ‘Settings’, then ‘General’ and then tap on ‘About’ — you should see the ‘Software Version’ displayed.

How do I check what version my operating system is (Android)?

Please note: There are a few versions of Android, so the steps you need to follow may not be covered in the general steps below — always refer to the device manufacturer’s instructions for full guidance.

To view your current version of Android:

-

Navigate to ‘Settings’

-

Tap ‘About Phone’, ‘About Device’ or ‘System’

-

Tap ‘Software Information’, ‘Android Version’ or ‘System Update’ to view the version you’re currently using. It may also just be displayed on the ‘About’ screen.

How do I update my operating system (iOS)?

If you need to update the operating system on your Apple device, you can usually do so in a few easy steps:

Before updating your device, consider backing it up to your iCloud or via your computer. It can also use up a lot of battery, so you may wish to plug in a charger.

- Connect to a secure wi-fi network.

- Navigate to ‘Settings’, then ‘General’ and tap ‘Software Update’

- If a new iOS version is available, it will be listed on screen

- Tap ‘Install now’ or ‘Download and install’

- Once installed, you should be able to use our app again.

Please visit the Apple website for more detailed instructions on how to update.

If an update is not available, your device may no longer be supported by Apple for their latest iOS software — please check with them to confirm this is the case.

I can no longer access the app - how do I access my account?

If you can no longer access the app and you can’t update your operating system or use a device with a newer version of iOS, then you will need to get in touch with our team by calling us on 0333 399 0050 (8am–8pm, 7 days a week) to discuss your options.

I can no longer access the app — what happens to my mortgage or savings account?

If you can’t access the app right now, please get in touch with our team by calling us on 0333 399 0050 (8am–8pm, 7 days a week) to discuss your options.

There may be some circumstances under which we may have to close your account if you do not upgrade your OS in line with our policy.

Fraud

What is savings APP fraud?

Authorised Push Payment (APP) fraud happens when members of the public authorise a payment to be sent from their bank account as part of a scam.

Some examples of APP fraud include:

- Purchase scams — a customer pays for goods or services they never receive

- Investment scams — a customer is tricked into investing money into a fraudulent scheme

- Impersonation scams — a customer is tricked into sending money to someone they believe is a legitimate business or individual

At Atom, we aim to make sure your money is safe and secure by only allowing you to transfer money in or out via a connected account.

If you suspect you have been a victim of APP fraud, please contact our Customer Support team immediately by calling 0333 399 0050 or via our in-app chat (8am–8pm, 7 days a week). You will be asked for details of the fraud and Customer Support will take you through the next steps, where applicable.

I believe I’m a victim of APP fraud, am I eligible for reimbursement?

If you are a victim of Authorised Push Payment (APP) fraud, you may be eligible for reimbursement. To be eligible, the APP scam payment must have been carried out using Faster Payments and sent to an account in the UK.

If you suspect you have been a victim of APP fraud, please contact our Customer Support team immediately by calling 0333 399 0050 or via our in-app chat (8am–8pm, 7 days a week).

Please note: exclusions apply and your claim may be denied in circumstances such as first-party fraud and gross negligence. The fraud payment must have been made on or after 7 October 2024 to be eligible. The maximum claim limit is £85,000.

We will be updating our terms and conditions to reflect the new policy at a later date.

Help

How can I make a complaint?

Head over to the How to complain page where we explain how you can make a complaint and exactly how we’ll deal with it.

What support is available to me?

For our savings and mortgage products you can do all your banking in the app. However, if you need a friendly voice to assist you with something, please contact our Customer Support Team. We also have a range of helpful videos on our YouTube channel.

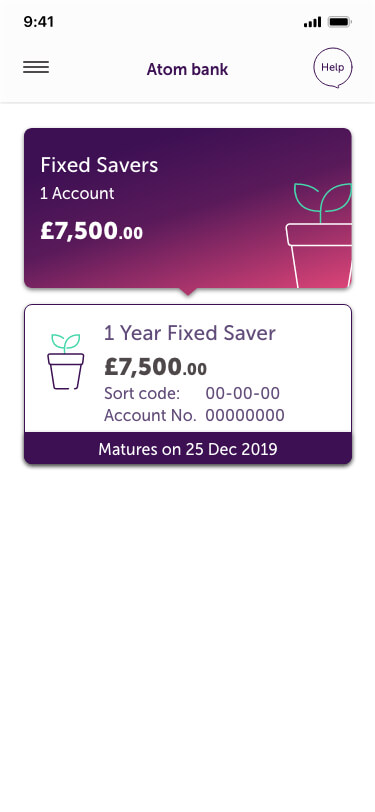

Where can I find my account number and sort code?

This info is on your account screen, here’s how to get there: Log in and you’ll be taken to your hub screen where you’ll see your accounts. Scroll to the account you’re interested in and you’ll see your account number and sort code.

Why do you need access to my camera and microphone?

We use biometric security which includes voice and face recognition to keep your account safe and secure. But we can’t do that unless we’re allowed to access your camera and microphone.

Why has my account application been rejected?

There are a few reasons why you might not have been able to open an account. Often, declines are due to mistakes in your personal details, which stop us matching your data with credit agencies.

To minimise this risk, please make sure the details you provided are correct and up-to-date, and that the bank details you’ve given us are from a UK current account in your name.

Money worries

General

Can you help me budget?

If you’re a mortgage or business loan customer (sole trader), we recommend that you complete an income and expenditure assessment at iehub.co.uk. This will give you a better understanding of the bigger picture of your financial situation, and may help you plan your budget.

If you’re a business loan customer who isn’t a sole trader, we recommend getting in touch with us on 0333 399 0050 and speaking to a commercial broker.

How can I check if I qualify for government support?

The UK Government offers support to qualifying homeowners through the Support for Mortgage Interest Scheme (SMI). Visit their website for more information and contact us should you want to discuss your situation or if you need further support.

I've had a major life event, which means I'm struggling to manage my mortgage or loan. Can you help me?

Yes, we can help. If your situation will impact your ability to repay outstanding debts, the first thing you should do is speak to your bank and any lenders you have a debt with, including us.

If you’re a mortgage or business loan customer (sole trader), we recommend that you complete an income and expenditure assessment at iehub.co.uk and share it with Atom bank before speaking with us. This will help us understand your situation and how best to help you. If you’d prefer to carry out an I&E assessment over the phone you can call us on 0333 399 0050 and we’ll take you through it.

You can find out what other support we can offer you on our Specialist Support page.

I've lost my job or my income has reduced. What should I do?

If your situation will impact your ability to repay outstanding debts, the first thing you should do is speak to your bank and any lenders you have a debt with, including us.

If you’re a mortgage or business loan customer (sole trader), we recommend that you complete an income and expenditure assessment at iehub.co.uk and share it with Atom bank before speaking with us. This will help us understand your situation and how best to help you. If you’d prefer to carry out an I&E assessment over the phone you can call us on 0333 399 0050 and we’ll take you through it.

You should also visit websites like Entitledto and Turn2Us to see whether you qualify for any benefits or extra assistance.

If you’re a business loan customer who isn’t a sole trader, we recommend getting in touch with us on 0333 399 0050 and speaking to a commercial broker.

Will contacting Atom about money worries affect my credit score?

No, speaking to us will not impact your credit score in any way.

Will you charge me additional fees if I miss a mortgage payment?

No, we want to support our customers and we have therefore removed any arrears management and missed payment charges. However, missing payments may still mean that you pay more over your mortgage term, so please get in touch as soon as possible.

I’m worried about my finances, but I haven’t missed a payment yet. What should I do?

Firstly, don’t panic. Simply get in touch as soon as possible if you’re concerned about making your payments. We’ll always work with you to understand your circumstances and find the best solution.

It’s really easy to contact us via the app, but if you don’t have access to it, you can call us on 0333 399 0050 or email customersupport@atombank.co.uk, our customer support centre is open from 8am to 8pm every day.

What if my personal circumstances are making it difficult for me to manage my payments?

People’s circumstances change all the time, we get that. That’s why we’ll always work with you to better understand your particular situation and find a solution. We know it may be a difficult time, but the sooner you can get in touch with us the sooner we can help.

It’s really easy to contact us via the app, but if you don’t have access to it, you can call us on 0333 399 0050, our customer support centre is open from 8am to 8pm every day.

What should I do if I’ve missed a payment or I can’t afford an upcoming payment?

Firstly, don’t panic. Simply get in touch as soon as possible and we’ll work with you to better understand your circumstances and find an affordable solution.

It’s really easy to contact us via the app, but if you don’t have access to it, you can call us on 0333 399 0050 or email customersupport@atombank.co.uk, our customer support centre is open from 8am to 8pm every day.

How do I get in touch to discuss my finances?

It’s really easy to contact us via the app, but if you don’t have access to it, you can call us on 0333 399 0050, our customer support centre is open from 8am to 8pm every day. We’re here to help, so let’s talk it over.

What other support is available?

We’ve partnered with iehub.co.uk to allow our customers to complete an online income and expenditure (I&E) assessment. IE Hub is a free, secure online portal that makes it really easy for you to share information about your income and outgoings with us. It’s straightforward, just:

- Create a free account with IE Hub at iehub.co.uk

- Follow the instructions to complete your I&E assessment

- Grant us access to your information by selecting to share with ‘Atom bank’ from the list of companies at the end of the assessment. Remember to add your mortgage account number as your reference and click submit.

Don’t worry, your information is completely safe and secure and will remain confidential - you can also remove access whenever you want. We’ll only use the information you share with us to assess the affordability of your mortgage payments. We only get notified when you’ve shared your I&E assessment, so as soon as we receive that update, we’ll be in touch at the earliest opportunity to discuss appropriate support.

If you’d prefer to carry out an I&E assessment over the phone you can call us on 0333 399 0050 and we’ll take you through it.

What is a payment deferral?

Put simply, this is an agreed fixed period of time where you don’t make any payments on your mortgage. Please bear in mind that you’ll still accrue interest and this may impact future lending decisions.

There are a range of other options available too and we can chat about these as soon as you get in touch.

What support or solutions are available to help me?

The good news is that we can potentially help you in a number of different ways. But before we get to that, we need to better understand your circumstances. Once we know what’s what we might suggest one of the following:

- Accepting reduced payments for a period of time, to allow time for your circumstances to improve.

- Arranging a plan to repay any money owed at an affordable monthly amount. This will be tailored to your individual circumstances and based on how much you can afford.

- Allowing you to pay your mortgage back over a longer period by extending your mortgage term. This will depend on your age and how long you have remaining on your term but it could help keep your payments affordable.

- Temporarily changing the type of your mortgage, for example by converting your repayment mortgage to interest only to reduce your monthly payments.

- Allowing you time to sell your property.

It’s important to understand that some of these solutions may not be appropriate based on your circumstances. You should also be aware that information on any solution may be reported to Credit Reference Agencies and could affect your eligibility for future borrowing. Additionally, depending on the solution your monthly payment may increase at the end of the solution and you may also pay more over the term of your mortgage. But before any solution is agreed we’ll give you more information on the potential impacts. What’s more, we’ll also provide you with information on how you can contact independent providers of debt help and money guidance.

As soon as you’re ready to discuss your individual circumstances with us, please get in touch and we’ll look at the options available to you and the impact they might have. It’s really easy to contact us via the app, or by calling 0333 3990050. You can also email customersupport@atombank.co.uk, our customer support centre is open from 8am to 8pm every day.

Where can I get independent guidance and help?

If you need independent support, or have debts with several creditors, we recommend contacting the following organisations for free, confidential and impartial debt advice (or a referral in your area):

- StepChange Debt Charity — Call 0800 138 1111 or use their free online debt advice service

- National Debtline — If you live in England, Wales or Scotland phone 0808 808 4000 or use their site’s instant chat service

- PayPlan — Call 0800 280 2816 or use the instant chat service on their website for advice

- Citizens Advice — Visit your local Bureau or go to their site for England and Wales, Scotland or Northern Ireland

- Money Helper — Visit their website for advice and several ways to get in touch with an adviser

- Money Advice Scotland — If you live in Scotland, call 0141 572 0237 or visit the website to find details for local debt advice.

- Advice NI — If you live in Northern Ireland, call 0808 802 0020 or visit the website for debt advice.

Need more help from us? Head to our specialist support page to get full details on all the different ways that we can assist you.

What happens if I don’t keep up with my payments and don’t contact you?

We hope it doesn’t get to that, but if it does, we’ll attempt to contact you as soon as we see payments are being missed to chat through your options. If we’re unable to reach you, we’ll have to consider bringing legal proceedings, which could include taking possession of your property. We’ll notify you well in advance of any legal proceedings starting though and will always aim to work with you to find an alternative solution where possible.

Business Banking

I’m worried about my business finances, but no payments have been missed yet. What should I do?

Firstly, don’t panic. If you have payment concerns please get in touch and we can talk through your situation and the options available. Call us on 0333 399 0050 or email customersupport@atombank.co.uk, our customer support centre is open from 8am to 8pm every day, and is ready to help.

What if my business circumstances are making it difficult to manage payments?

We’ll always work with you to understand the business’ circumstances and find a solution. We understand it may be a difficult time, that’s why it’s really important to get in touch sooner rather than later. We’re here to help, so please call us on 0333 399 0050 or email customersupport@atombank.co.uk, our customer support centre is open from 8am to 8pm every day.

What should I do if a payment has been missed?

Please get in touch as soon as possible and we’ll work with you to find an affordable payment solution.

You can call us on 0333 399 0050 or email customersupport@atombank.co.uk, our customer support centre is open from 8am to 8pm every day.

How do I get in touch to discuss my business finances?

Simply call us on 0333 399 0050 or email customersupport@atombank.co.uk. We’re here to help, so whatever financial issues your business is facing, let’s talk it over and see what we can do for you.

Do my business’ financial difficulties need to be related to the COVID-19 pandemic for Atom to support me?

No, not at all. If you have any concerns about your business’ finances, please get in touch – whether this is related to COVID-19 or not. The most important thing is that you get in touch as soon as you think there may be an issue.

You can call us on 0333 399 0050 or email customersupport@atombank.co.uk, our customer support centre is open from 8am to 8pm every day.

What is a payment deferral?

Put simply, this is an agreed fixed period of time where you don’t make any payments on your business loan. However, please be aware that interest will still be accrued and this may impact lending decisions in the future.

The good news is that we offer a range of options and we’ll be able to talk these through with you as soon as you get in touch.

The business can’t afford the next payment, what should I do?

We understand the pressures businesses face, so as soon as you have any concerns about your finances, please get in touch. There are a number of ways we can support you which we can discuss with you to see if your business might be eligible. The most important thing is that you get in touch the moment you think there may be an issue.

You can call us on 0333 399 0050 or email customersupport@atombank.co.uk, our customer support centre is open from 8am to 8pm every day.

What support might be available to help me?

Once we’ve fully understood the issues you and your business are facing, we’ll put together some support packages that are appropriate and sustainable for your circumstances. These might include a payment arrangement or changes to elements of your loan.

To help us better understand your concerns, and to discuss your options and any potential impact, call us on 0333 399 0050 or email customersupport@atombank.co.uk.

Where else can I get help?

As well as talking to us about your financial difficulties, you can also contact Business Debtline, a charity that provides free debt advice for small businesses and the self-employed.

Simply visit www.businessdebtline.org or call 0800 197 6026.

Instant Saver

Can I put money in and take money out of an Atom Instant Saver?

Yes, as it’s an easy-access account, you can withdraw or add money instantly, as many times as you like. You just need the Atom app and a UK current account in your name to get started.

Is there a minimum deposit for the Instant Saver account?

There is no minimum deposit for Instant Saver. It’s for everyone and you can open an account with £0. There are no withdrawal restrictions either and you don’t have to go into your bank, it’s just a few clicks away within the Atom app.

How old do I have to be to open an Instant Saver?

You will need to be 18 or over to open an Instant Saver.

Do I need a current account to open an Instant Saver?

Yes, you’ll need to connect a UK current account to your Instant Saver to transfer money in and out. The current account must be in your name and registered to your address.

How many Atom Instant Saver accounts can I open?

You can hold one Instant Saver.

You can also hold one Saver Reward account.

Can an Atom Instant Saver be set up as a joint account?

Currently, Instant Saver accounts can only be opened as sole accounts (just you) and are limited to one per customer.

Are there any charges for opening an Instant Saver or taking money out?

There are no charges for opening an Instant Saver or for withdrawing your money.

Can the Instant Saver interest rate change?

Yes. The Instant Saver interest rate is variable, so can change from time to time. We’ll always let you know when it changes though, and give you at least 14 days’ notice if it goes down.

You can find more info about changes to your interest rate and how we’ll tell you about them in the Instant Saver T&Cs.

How do I add funds to my Instant Saver?

It’s really easy to add funds to your Instant Saver. Just make a bank transfer from your connected UK current account using the sort code and account number of your Atom account. If you like, you can add a reference to help you spot the transaction on your bank statements.

Your funds will typically land in your Instant Saver almost immediately, though sometimes your current account provider will need to run some checks before they make the transfer, so this can slow things down.

When you add funds to your account, it’s worth keeping in mind that you can’t exceed our Maximum Balance Limit. This stands at £200,000 per customer, split into £100,000 for total funds held in for your easy-access accounts at any time (Instant Saver, Saver Reward and Holding Account) and £100,000 for total funds held in your Fixed Saver accounts at any time.

How long will it take to add funds to my Instant Saver?

When you add money to your Instant Saver, the transfer usually goes through very quickly. There might be some occasions when your connected account provider needs to run some checks as your money leaves them, which may slow things down.

Once we get your funds, however, we usually add them to your account right away, though we may need to run some checks on incoming transactions from time to time.

How long will it take to withdraw funds from my Instant Saver?

Our Instant Saver is nice and flexible, so you can withdraw funds and they’ll be with you almost immediately. Things may take a little longer if we need to verify the transaction.

What reference should I use when I add funds?

You can add any reference you want when making a payment. We recommend keeping them sensible, as they might need to be reviewed by someone further down the line, such as when you apply for a mortgage.

How much can I save in an Instant Saver?

You can hold up to £100,000 across your Atom easy-access accounts at any time (Instant Saver, Instant Saver Reward and/or Holding Accounts). We may go over this limit in some circumstances, for example to add interest to your account.

If you exceed the £100,000 limit across your easy-access accounts, we’ll automatically move the excess amount back to your connected account.

There is a Maximum Balance Limit of £200,000 for your total funds held across all savings accounts at any time with Atom (including a £100,000 limit for Fixed Savers).

Can I move funds between my Instant Saver and my Fixed Saver?

Yes, you can choose to move funds between your Instant Saver and Fixed Saver at certain times.

You can move money from your Instant Saver account to your chosen Fixed Saver account within your 7 day deposit funding window. For unfunded Fixed Saver accounts, the funds transferred need to be at least £50. If your Instant Saver has less than £50 in the account, the option to transfer to a Fixed Saver will not appear.

When your Fixed Saver matures, you’ll have the option to move your funds straight to your Instant Saver, as long as you have one open before your Fixed Saver reaches maturity.

If you miss the 3-day maturity window for a Fixed Saver, we’ll automatically move funds to your Instant Saver if you have one open (or a Saver Reward if that is your only Atom easy-access account).

Please note: When moving money between your Instant and Fixed Saver, you need to be aware of our Maximum Balance Limit. You can hold up to £100,000 in total across all of your Fixed Savers at any time and up to £100,000 in total across all of your easy-access accounts at any time (Instant Saver, Saver Reward and any Holding Account). There is also a limit of £200,000 in total across all of your savings accounts at any time. You can find full details of these limits in your Fixed Saver T&Cs (available in your Vault).

Can I move money from my Instant Saver to my Instant Saver Reward?

Yes, but not directly in the app. We’ll be adding this option in the future though, so be sure to check back here to find out how.

Instead, you can transfer funds from your Instant Saver to your connected account, then pay those into your Saver Reward once they’ve arrived.

To do this:

- Select your Instant Saver in the app.

- Choose the “Move money” option, select your connected account and enter how much you’d like to withdraw.

- Complete the withdrawal and your funds will be transferred to your connected account.

- Head to your connected account and pay into your Instant Saver Reward by using its bank details.

Note: if you use different connected accounts for your Instant Saver and Instant Saver Reward, please ensure you transfer the funds to your Instant Saver Reward connected account first.

Can I send Instant Saver funds to my external savings and/or current account?

Instant Saver funds can only be paid into your connected account, which has to be a UK personal current account in your name and registered at your address.

When will I get statements for my Instant Saver?

You’ll get your statements monthly and annually, and we’ll let you know when they’re ready in the app. You can also see all your transactions in the app on a day-to-day basis.

Does the FSCS protection also apply to Atom's Instant Saver?

All your savings with Atom are protected by the FSCS (Financial Services Compensation Scheme) up to a total value of £85,000.

Please note: this is the total protection value across all Atom savings accounts and not applied per savings account.

Is an Instant Saver account an ISA?

No, they’re different. An ISA (its full name is Individual Savings Account) offers tax-free interest payments, plus there’s a limit on how much money you can put into an ISA in each tax year.

You may have to pay tax on the interest you earn from our Instant Saver, depending on your Personal Savings Allowance and you can put in up to £100,000.

How do I close my Instant Saver account?

You can close your Instant Saver account directly in the Atom app in just a few minutes, with the following steps:

- Select your Instant Access account in-app

- Click on the ‘Close account’ option

- If you have funds in your account, you will be prompted to move them to your connected external account to empty your Instant Saver balance.

- Once empty, you can now select to finalise closing your account

Please note, although you will be permanently closing your account, you will still be able to view all of your previous statements and transactions.

If you just want to change your connected account, you don’t need to close your Instant Saver. Just select the ‘Connected account’ option from your account screen.

Looking to move your Instant Saver funds to a Fixed Saver? You can transfer your money straight over to one that’s within its funding window by choosing the ‘Withdraw money’ option from your Instant Saver account screen and selecting your Fixed Saver.

Can I rename my Instant Saver?

No, you can’t rename your Instant Saver.

Instant Saver Reward

What’s the difference between the Saver Reward and Instant Saver?

Our Instant Saver and Saver Reward are both easy-access savings accounts, which means you can add or withdraw funds at any time.

The difference between the two accounts is that we offer different interest rates for our Saver Reward based on how you use the account. In a nutshell, we pay a higher rate when you don’t withdraw and a lower rate when you do.

Our Instant Saver has just one rate that we pay, whether you withdraw your funds or not.

Please note: both types of accounts also have a variable rate of interest, which means it can go up or down at any time.

Can I put money in and take money out of a Saver Reward?

Yes, our Saver Reward is an easy-access account, like our Instant Saver. This means that you can add or withdraw your money at any time in just minutes.

It’s worth remembering that if you do withdraw, you will switch to a lower interest rate for the rest of the month. However, you will move back to the higher reward rate at the start of the next monthly interest period.

Is there a minimum deposit for the Saver Reward account?

You don’t need to make a minimum deposit for our Saver Reward — you can open an account with £0.

How old do I have to be to open a Saver Reward account?

You need to be 18 or over to open a Saver Reward account.

Do I need a current account to open a Saver Reward?

Yes, you need a UK current account in your name and registered to your address to use as your connected account. This is the account you’ll use to transfer money in and out of your Saver Reward.

How many Saver Reward accounts can I open?

You can hold one Saver Reward account. In addition, you can hold one Instant Saver account.

Can a Saver Reward be set up as a joint account?

No, you can only set up one Saver Reward as a sole account for yourself.

Are there any charges for opening a Saver Reward or taking money out?

No, there aren’t any charges for opening a Saver Reward or withdrawing money.

Could my Saver Reward interest rate change?

Yes, the Saver Reward has a variable interest rate, so it can go up and down. We will always notify you of any change, with at least 14 days notice if it decreases. Head to the Instant Saver Reward T&Cs to find out more.

When will my Saver Reward interest be paid?

Your interest will be paid monthly on the day of the month you open the account. For example, if you open the account on the 16th, your interest will be paid on the 16th day of every month.

If you open your account on the 29th, 30th or 31st and that date doesn’t appear in a subsequent month, your interest will be paid on the last day of the month.

How can I check my interest rate?

You can check your interest rate at any time by logging into the app and navigating to your account.

If I withdraw from my Saver Reward mid-month, what rate will I get?

When you withdraw from your Saver Reward, you’ll receive the lower withdrawal rate when your interest is calculated and paid at the end of the monthly interest period. If you withdraw mid-month, your interest will be calculated at the Withdrawal rate for the whole monthly interest period. You can check your app or our Saver Reward page for the latest rates.

How do I add money to my Saver Reward account?

You can add money to your Saver Reward from your connected account.

To transfer money in, you’ll need to make a bank transfer from your connected account to your Saver Reward. You can find the sort code and account number for your Saver Reward account in the app. Your money will usually appear in your Saver Reward as soon as it is sent from your connected account.

How long will it take to add funds to my Saver Reward?

It doesn’t take long to add money to your Saver Reward, and it should appear very quickly. Occasionally, the transaction may be slower if your connected account provider needs to check something.

Typically, once we receive the funds they’re added straight to your account.

How long will it take to withdraw funds from my Saver Reward?

Our Saver Reward is an easy-access account so it takes very little time to withdraw your money. On occasion, we may need to verify a transaction, which may result in a delay.

What reference should I use when I add funds to my Saver Reward?

You’re free to use any reference you want. However, we do recommend that you use something sensible, as your account history may later need to be looked at by someone assessing your finances, like when you apply for a mortgage.

How do I withdraw money from my Saver Reward?

You can withdraw funds from your Saver Reward in just a few taps. Log into the app and select your account, then choose the “Withdraw money” option. We’ll then let you choose how much and complete your withdrawal straight to your connected account.

How much can I save in a Saver Reward?

You can hold up to £100,000 in total across your Atom easy-access accounts at any time (Instant Saver, Instant Saver Reward and/or Holding Accounts). We may go over this limit in some circumstances, for example to add interest to your account.

If you exceed the £100,000 limit across your easy-access accounts, we’ll automatically move the excess amount back to your connected account.

There is a Maximum Balance Limit of £200,000 on the total funds held across all savings accounts at any time with Atom (including a £100,000 limit for Fixed Savers).

Can I move funds between my Saver Reward and Fixed Saver?

Yes, you can move funds between your Saver Reward and Fixed Saver. However, you can only do this at certain times.

You’re able to move money from your Saver Reward to a Fixed Saver during the Fixed Saver’s seven day deposit funding window. For unfunded Fixed Saver accounts, the funds transferred need to be at least £50. If your Saver Reward has less than £50 in the account, the option to transfer to a Fixed Saver will not appear.

Once a Fixed Saver matures, you can move funds from it straight to your Saver Reward, provided it’s open before your Fixed Saver matures. If you don’t let us know what you want to do with your Fixed Saver at maturity, we’ll automatically move your funds to your Instant Saver or Saver Reward, if you have one open (we’ll give preference to your Instant Saver if you have both).

Please note that when moving money between your easy-access accounts (Instant Saver, Saver Reward and Holding Accounts) and Fixed Savers, you need to be aware of our Maximum Balance Limit. You can hold up to £100,000 in total across all of your Fixed Savers at any time and up to £100,000 in total across all of your easy-access accounts at any time. There is also a limit of £200,000 on the total funds held across all of your savings accounts at any time. You can find full details of these limits in your product T&Cs (available in your Vault).

Can I move money from my Instant Saver Reward to my Instant Saver?

Yes, but this feature isn’t available directly in the app yet. We’re working on adding it in the future, so please check back later for instructions.

For now, you can move funds by transferring them from your Saver Reward to your connected account. You can then deposit them from your connected account into your Instant Saver.

To do this:

- Choose your Instant Saver Reward in the app.

- Select “Move money,” choose your connected account, and enter the amount you want to withdraw.

- Complete the withdrawal process, and the funds will be sent to your connected account.

- Access your connected account and deposit the funds into your Instant Saver by using its bank details.

Note: If your Instant Saver and Instant Saver Reward are connected to separate accounts, make sure to transfer the money to the connected account associated with your Instant Saver first.

When will I get statements for my Saver Reward?

At the end of each monthly interest period, we’ll put your monthly statement in your Vault and let you know it’s ready. We’ll also let you know when we put your annual statement in your Vault. We will add this within a few days of your account opening anniversary.

Is my Saver Reward covered by FSCS?

Yes, your Saver Reward and all your savings with Atom are protected by the FSCS (Financial Services Compensation Scheme) up to a total value of £85,000.

Please note: this is the total protection value across all Atom savings accounts and not applied per savings account.

Can I rename my Saver Reward?

No, you cannot rename your Saver Reward account.

Fixed Saver

What is a Fixed Saver account?

A Fixed Saver account is a fixed rate savings account that is opened and funded through our app. These accounts have a fixed interest rate which is set for the term of the product chosen.

How do Fixed Savers work?

Once you’ve downloaded the Atom bank app, registered your ID and verified your identity, you can open a Fixed Saver account within the app.

When you open an account, you’ll receive a fixed rate of interest on the money you put in it for the specified term, starting from the day you opened the account. You can see the term and rate that apply to your product in the account view in the App.

Fixed Savers don’t have a ‘cooling off’ period (a reflection time when you have the option to change your mind and close the account), so please make sure this product is right for you before you open an account and pay.

These accounts have an initial seven-day deposit window in which you can add funds to your account and no further additions can be made beyond this time. At the end of your fixed term, your account will reach maturity. Shortly before this date, we will contact you to remind you and at this point you can choose what to do with your funds.

How do I fund my Fixed Saver?

You can make payments into your account directly from your Instant Saver or Saver Reward account, if you have one, or from another bank or building society during the deposit window. Inbound payments from another bank or building society will usually show in the app immediately, but we suggest that you check with the other bank or building society that they’re able to transfer the funds before your deposit window closes. Payments in and out of a Fixed Saver can only be made using the Faster Payment Service.

We cannot accept liability for any payments from other institutions that we receive outside of your deposit window. You’ll find more information about making payments in our General T&Cs. In some circumstances (e.g. if we use your bank account details to verify your identity) you will only be able to make payments into your account from a specified UK bank account in your name. Once you’ve paid money into your account, you can’t withdraw it until the end of your product term.

Please note: We don’t accept funds by CHAPS or cheque.

Can I move funds between my Fixed Saver and my Instant Saver or Saver Reward?

Yes, you can choose to move funds between your Fixed Saver and Instant Saver or Saver Reward at certain times.

When your Fixed Saver matures, you’ll have the option to move your funds straight to your Instant Saver or Saver Reward, as long as you have one open before your Fixed Saver reaches maturity.

If you miss the 3-day maturity window for a Fixed Saver, we’ll automatically move your funds to your Instant Saver or Saver Reward, if you have one open (we’ll give preference to your Instant Saver if you have both).

You can move money from your Instant Saver or Saver Reward to your chosen Fixed Saver account within your 7 day deposit funding window. For unfunded Fixed Saver accounts, the funds transferred need to be at least £50. If your Instant Saver or Saver Reward has less than £50 in the account, the option to transfer to a Fixed Saver will not appear.

Please note: When moving money between your easy-access accounts (Instant Saver, Saver Reward and Holding Accounts) and Fixed Savers, you need to be aware of our Maximum Balance Limit. You can hold up to £100,000 in total across all of your Fixed Savers at any time and up to £100,000 in total across all of your easy-access accounts at any time. There is also a limit of £200,000 in total across all of your savings accounts at any time. You can find full details of these limits in your product T&Cs (available in your Vault).

Is the Fixed Saver covered by FSCS?

Yes. Your money will be covered by the Financial Services Compensation Scheme (FSCS), which means your deposits are protected up to £85,000 should anything happen to the bank. If you open an Atom bank savings account, we will upload an FSCS Info Sheet to your Vault.

Is there a minimum deposit for the Fixed Saver?

A Fixed Saver can be opened without an initial deposit, however the first deposit needs to be a minimum of £50.

Once you’ve opened your account, you can only make payments into it for a specified period. We call this the ‘deposit window’. The deposit window starts as soon as you open your account and closes at a fixed point in the future.

After making the minimum initial payment specified in your Fixed Saver summary box, you can make as many payments as you like into your account during the deposit window, up to the Maximum Balance Limit.

If you open an account and don’t pay anything into it during the deposit window, the account will be registered as an ‘unfunded’ account, and we’ll close it in due course.

What are the different terms for a Fixed Saver?

Our Fixed Savers range from 6 months to 5 years and are available in both monthly and annual interest payment options. Visit our Fixed Saver page for a full range or check out the options on our app.

Who is eligible for a Fixed Saver?

Anyone who is aged 18 or above, is a UK resident and who owns a compatible smart device is eligible to open a Fixed Saver account.

Can I add to or withdraw money from a Fixed Saver?

During the deposit window, you can add funds as many times as you like up to the £100,000 limit, as set out in the Fixed Saver Terms & Conditions. There is also a £200,000 limit across all of your Atom accounts (including a £100,000 balance limit applied to any easy access accounts i.e. an Instant Saver and Holding Accounts). Outside of the deposit window, no additional funds are permitted on Fixed saver accounts.

Funds can only be withdrawn from a Fixed Saver at maturity of the term or in the case of financial hardship. If you’re struggling financially, please contact our Customer Support team on 0333 399 0050 (8am to 8pm, 7 days a week) or via the chat option in your app, and we’ll look to assist you. We may require evidence to support your request, but it’s important you get in touch as soon as you can.

What is the maximum deposit I can put in a Fixed Saver?

There is a Maximum Balance Limit that applies to our savings accounts. You can deposit up to £100,000 in total across all your Fixed Savers. There is also a maximum limit of £200,000 across all your accounts, which includes a £100,000 limit across all your easy-access accounts, including Instant Saver and Holding Accounts.

How many Fixed Saver accounts can I open?

You can open as many Fixed Saver accounts as you like as long as you stay within the Maximum Balance Limit for your savings accounts.

What is the difference between pay in and pay out for interest payments?

You may choose to have interest added to your account (‘paid in’) or paid into your nominated account, which is another bank or building society account in your name (‘paid out’).

Can my rate change?

Once you’ve opened a Fixed Saver, your rate won’t change at all. It’s completely fixed.

What does maturity mean?

Maturity is the term used to describe the end of the term on your Fixed Saver.

What happens at maturity for my Fixed Saver?

As your maturity date approaches we will send you reminders and instructions of what you will need to do to provide instructions (this means choosing what you wish to do upon your maturity date). You can provide instructions in the app within your maturity window, this is the three days before your maturity date.

When will I be notified before maturity?

You will receive a notification 28 days, 14 days and three days before your account is due to mature. You will also receive an email to your email address three days before maturity.

Please note: We’ll send your 28-day and 14-day reminders by push notification, so you need to make sure you keep these switched on.

What do I need to do to provide my maturity instructions?

Once you receive the notification three days before maturity, you can then go into the app and provide your instructions. You can’t do this before that date.

If you change your mind, you can change your maturity instruction prior to your maturity date in the app however this can’t be done on the date of maturity or afterwards.

What are my options when reaching maturity?

At maturity, you can choose to:

- Reinvest the full amount into a new Fixed Saver

- Withdraw the full amount to an external bank account in your name

- Reinvest some of the funds into a new Fixed Saver and withdraw the rest to an external bank account

- Invest the full amount into a new Instant Saver or Saver Reward account (if you don’t already have one open)

- Invest the full amount into an existing Instant Saver or Saver Reward account (if you already have an account open)

- Invest some of the funds into an existing Instant Saver or Saver Reward account and withdraw the rest to an external bank account

If you miss the 3-day maturity window for a Fixed Saver, we’ll automatically move your funds to your Instant Saver or Saver Reward (if you have both then we’ll give preference to your Instant Saver if you have both). Otherwise, your funds will move to a Holding Account, where you’ll typically earn a lower rate of interest.

If your money is moved into a Holding Account, you will have the same options as at maturity, so you can choose to withdraw, reinvest into a new Atom account, or split between reinvesting and withdrawing. However, you must move all of your money in one go.

What happens if the rate changes within my maturity window?

If you choose to reinvest your funds at maturity within your three day maturity window and the rate changes, as part of our best rate guarantee you will get the higher rate upon your maturity date.

Please note: Best rate guarantee is only applicable at maturity and upon instructions being provided within the three day maturity window.

What is the difference between a Fixed Saver and an Atom easy-access account?

A Fixed Saver is a fixed rate savings account, where your funds are locked away until the term ends and you can only deposit funds within the seven day deposit window.

An Atom easy-access account (Instant Saver/Saver Reward) allows you to make unlimited deposits and withdrawals at any time (though you can’t hold more than £100,000 across your Instant Saver, Saver Reward and Holding Accounts at any time).

Note: A Holding Account is also an easy-access account but you can’t deposit any funds yourself. You can only withdraw, reinvest into a new Atom account, or split between reinvesting and withdrawing. You must also move all of your money in one go.

What if I change my mind about opening a Fixed Saver?