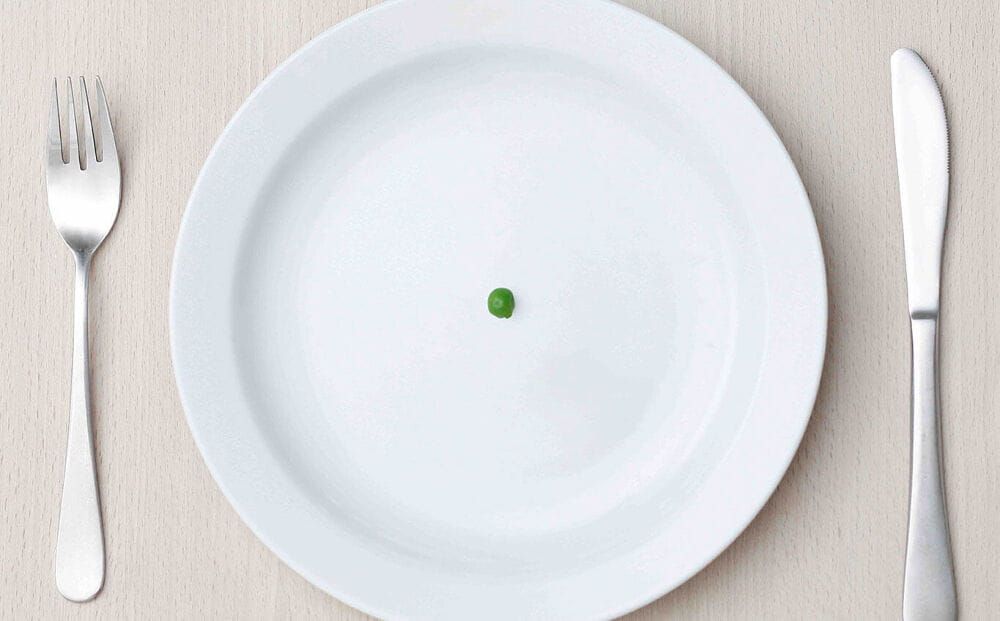

It’s just not enough

Archive

It’s just not enough

Underwhelming and unsurprising, why the CMA report falls short

Last week the CMA (the Competition and Markets Authority) published its long awaited report into the market for personal and small business current accounts here in the UK. It’s been reviewing the market for over two years and it has consulted widely and been commendably open and upfront about who it’s talked with and what they have said. Individual banks can and have chosen to withhold data from public disclosure on grounds of sensitivity but a quick visit to CMAGov.co.ukwill allow anyone to see what they have seen.

In public I have described the CMA’s recommendations as both underwhelming and unsurprising, but in private I’m actually annoyed and upset about them. Now any cynics among you (and I suspect there might be one or two of you out there) who read that a banker is annoyed and upset can be forgiven for wincing or for playing your imaginary violins but, however improbable, it really is true. I can’t quite decide whether I’m angry or just depressed by it all. And I’m not the only voice of criticism. The independent consumer group Which? has also bemoaned the failure of the CMA to impose caps on the sums banks can charge customers for overdraft facilities. But is the criticism justified?

When I started working in banking in the early 1990’s overdraft fees mostly didn’t exist. Back then they were typically called ‘Penalty Fees’ and generally they cost £30 a pop (the charge for breaching your overdraft limit) but in 2007 the Office of Fair Trading (which in 2014 morphed into the CMA) determined that it should test whether these fees constituted unfair charges. In 2009, having lost a High Court ruling, the OFT decided not to proceed with the case, instead pursuing the matter using regulatory channels. This case is important because it most likely informs the CMA’s approach to overdrafts in their latest investigation – in short, I believe there is form here!

Of course purely coincidentally around the time of the OFT investigation, lots of the banks commissioned detailed reviews of their banking and overdraft terms and conditions and the language used to describe fees and charges. Out went the term ‘penalty’ and in came words like ‘authorised’, ‘arranged’, ‘unauthorised’, ‘formal’ and ‘informal. And in spite of these changes (many of which simply further confused everyone) and with the exception of PPI complaints, in all the years I have worked in banks the single biggest source of complaints, in my experience, has been overdraft fees and charges (or penalties!!!).

But in spite of gradually reducing the amount of money that they make from overdrafts (like weaning themselves off sugar ), today UK banks still make (I can’t make myself use the word ‘earn’) well over £1bn from overdrafts. In short they are a disgrace to the banking profession.

But having lost back in 2009, it looks to me like the CMA, known then as the OFT, didn’t want to risk a messy argument with the banks by imposing a cap on the amount they can charge their overdraft customers in 2016.

So let’s ask, is it fair that a bank should charge a customer for borrowing to which they didn’t agree in advance of it happening? We know that customers who use overdrafts would prefer that their payments were not declined in a way that causes them embarrassment. Banks could impose a hard limit on overdrafts and simply decline payments once that limit has been reached. But they don’t because their customers want some flexibility and are prepared to pay for that flexibility. But up to £90 in fees a month (to say nothing of debit interest) for a small sum of borrowing?

It’s been my experience that customers expect to be treated proportionately. Throughout our life we learn that the more we spend, the more we get and vice versa. But when a penalty is disproportionate to an offence, it’s hard not to feel a real sense of injustice. It’s this moral outrage as much as the actual cost that prompts people to complain so vociferously about overdraft fees. I have learned that people in the UK have an almost unerring sense of fairness and they are tenacious in their pursuit of justice. The decision by the CMA to let banks set their own caps is, I’m afraid, unsurprising. They got a bloody nose once before in this fight. It’s a great shame that they hadn’t the courage to get another one. Sometimes it’s not about winning – it’s about doing the right thing.