Fixed Rate Saver

Lock in a rate and watch your money get to work.

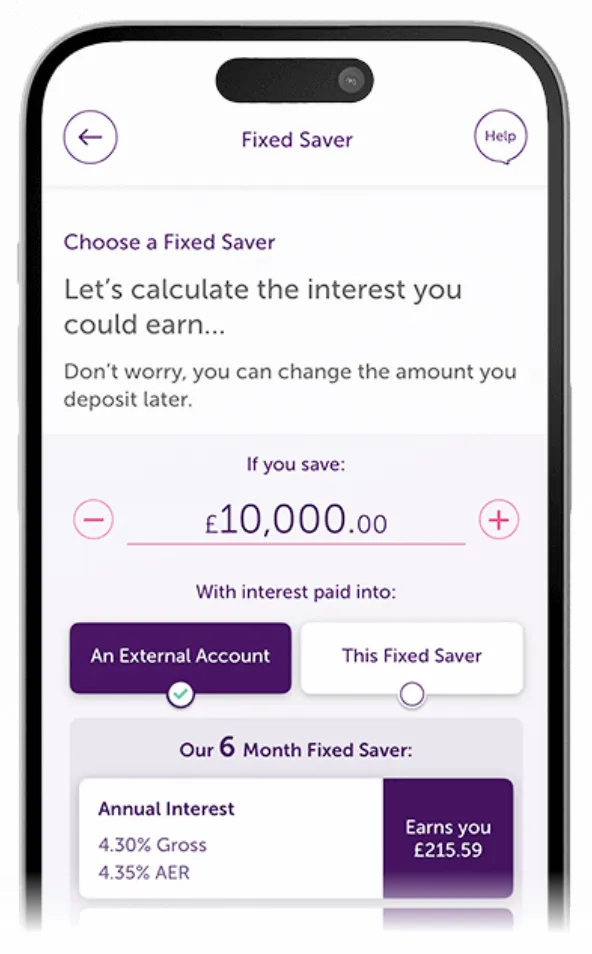

Our Fixed Saver accounts are available with a range of terms from 6 months to 5 years. They can be opened in 10 minutes, from wherever you are, via our app. Compare all our fixed rates and terms below and find the one that works for you.

Up to 4.15% AER on a 5 year fixed term

Open with £50 to £100,000 during the deposit window

Super fast and secure setup

No withdrawals until the term ends

What is a fixed rate savings account?

A fixed rate savings account, also known as a fixed rate bond or a fixed term savings account, allows you to save money for a set amount of time with a fixed interest rate that does not change.

Once you add your money, it will be locked in and you won’t be able to access it, but you will know exactly how much interest you will earn by the time the account has matured.

A fixed term saving account might be a good option if you’ve got a lump sum that you don’t need access to for a while. Your money could work harder when it’s locked away.

Our fixed rate savings accounts

Our Fixed Savers allow you to save between £50 to £100,000 over the time period that suits you. Use our fixed rate savings calculator below to find out how much interest you could earn.

6 Month

Annual interestGross

3.67%

AER

3.70%

Earns you around

£18.20*

6 Month

Monthly interestGross

3.64%

AER

3.70%

Earns you around

£18.19*

9 Month

Annual interestGross

3.68%

AER

3.70%

Earns you around

£27.52*

9 Month

Monthly interestGross

3.64%

AER

3.70%

Earns you around

£27.57*

1 Year

Annual interestGross

3.90%

AER

3.90%

Earns you around

£39.00*

1 Year

Monthly interestGross

3.83%

AER

3.90%

Earns you around

£38.99*

2 Year

Annual interestGross

4.05%

AER

4.05%

Earns you around

£82.64*

2 Year

Monthly interestGross

3.98%

AER

4.05%

Earns you around

£82.73*

3 Year

Annual interestGross

4.11%

AER

4.11%

Earns you around

£128.56*

3 Year

Monthly interestGross

4.03%

AER

4.11%

Earns you around

£128.42*

5 Year

Annual interestGross

4.15%

AER

4.15%

Earns you around

£225.58*

5 Year

Monthly interestGross

4.07%

AER

4.15%

Earns you around

£225.45*

* The estimated total interest is calculated using the gross interest rate. It assumes you deposit the full amount on the day the account opens and that all interest is paid into the account. The date you open the account may affect the amount of interest you receive.

‘AER’ means ‘annual equivalent rate’ and is designed to make it easy for you to compare savings products. It tells you how much interest you’d earn if you put some money in an account and left it there for a full year. It takes account of things like how often the interest is paid and assumes any interest paid during that year is added to the balance and earns interest.

Gross rate is the interest rate paid on an account before any taxes or other deductions are accounted for.

We will not deduct any tax from your interest. You are responsible for paying any tax due to HM Revenue and Customs on interest that exceeds your Personal Savings Allowance.

To view our archived rates, click here.

Why open a Fixed Saver with Atom bank?

Competitive fixed interest rates

Everything happens on the app, so we don’t have to shell out on branches. We pass the savings onto you in the form of better fixed rate savings.

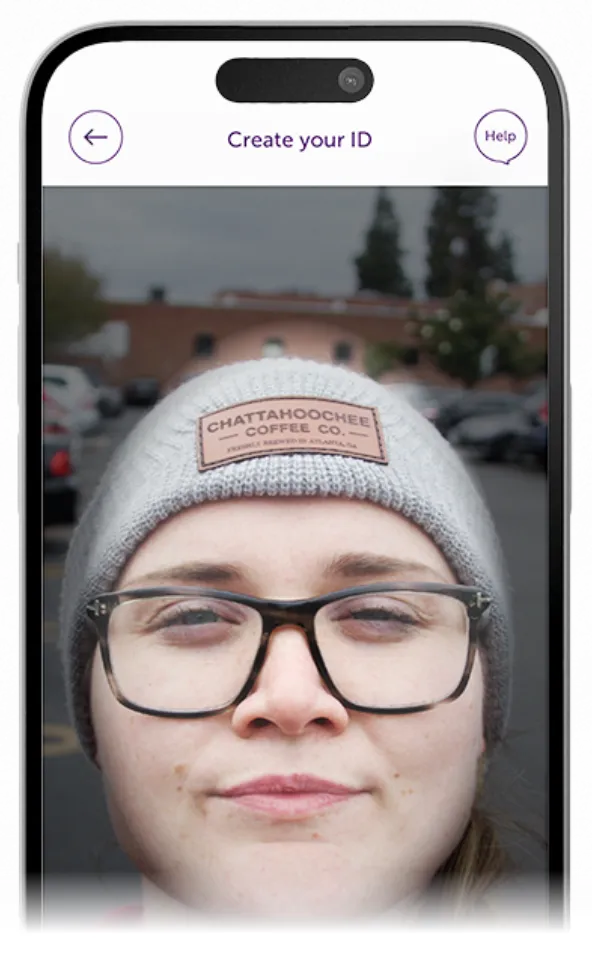

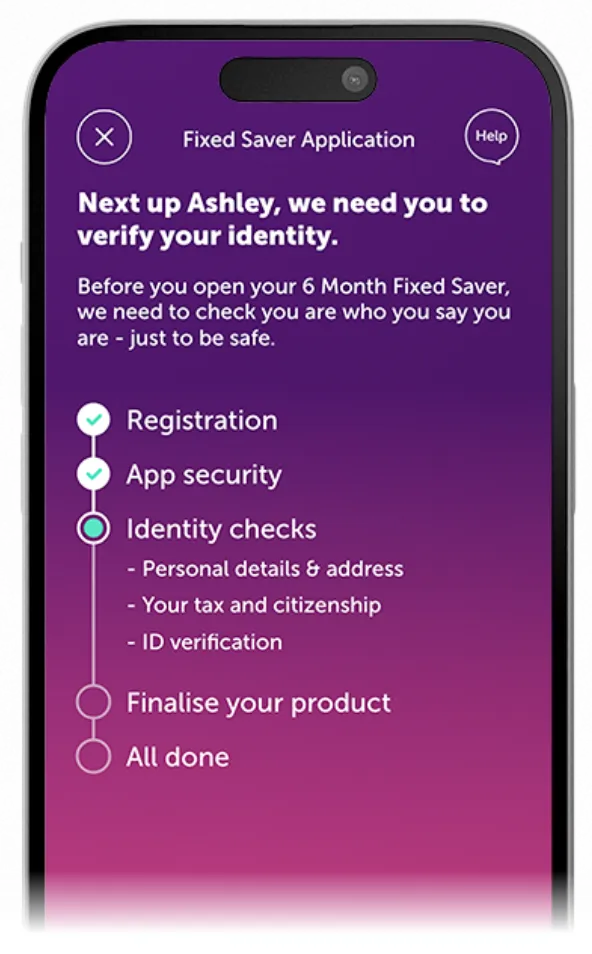

Super-fast setup

Open a fixed rate saver account in as little as 10 minutes.

Your money's locked in

Once you put money in a Fixed Saver it remains secure on a fixed rate of interest until the fixed term ends.

Easy saving planning

You’ll know exactly what your rate will be for the duration of the term, so you can easily plan ahead.

Great for lump sums

Our Fixed Saver is ideal if you have a lump sum and want to make it work for you by earning interest over a fixed term.

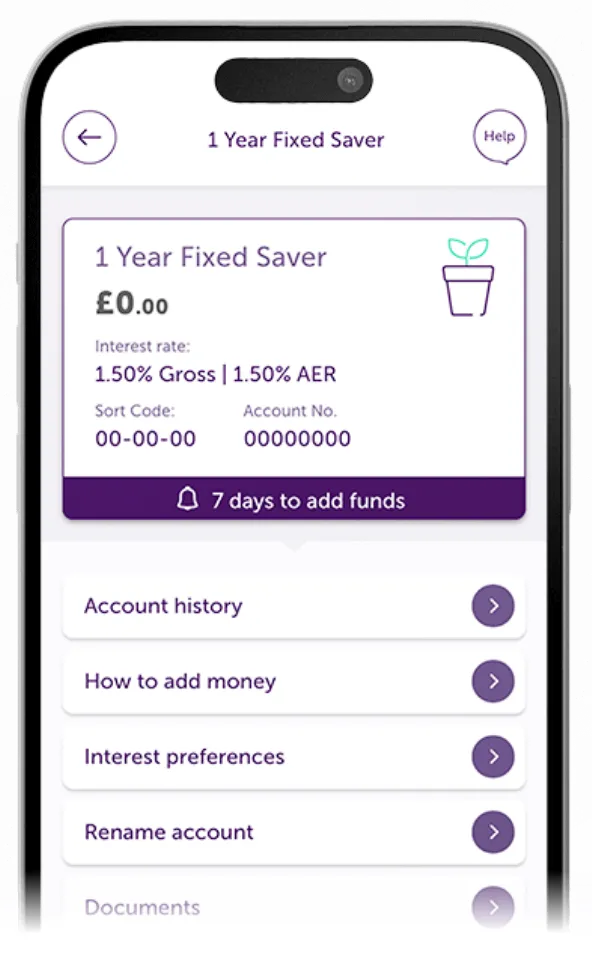

Simple funding

Fund your Fixed Saver within 7 days of opening, directly from your Instant Saver or Instant Saver Reward, or by an electronic transfer from another bank or building society.

ONCE YOU PUT MONEY INTO A FIXED SAVER, YOU CAN'T GET IT OUT UNTIL THE FIXED TERM ENDS

FSCS Protection

What's this all about? Well, in a nutshell your money will be covered by the Financial Services Compensation Scheme (FSCS), which means your deposits are protected up to £120,000 should anything happen to the bank.

How do I open a Fixed Saver?

We’ve made it easy to open our savings accounts. There’s no paperwork or fuss and you can get started in minutes.

The interest rates shown in these images are examples only and may not reflect our current rates.

Here’s what our customers have to say

Our customers are big fans of our savings products! Check out Feefo, an independent review site to hear why.

Fixed Saver Summary Box

Account name: Fixed Saver

| Term | Gross | AER | Effective from |

|---|---|---|---|

| 6 Month Fixed Saver (Annual interest) | 3.67% | 3.70% | 25/02/2026 |

| 6 Month Fixed Saver (Monthly interest) | 3.64% | 3.70% | 25/02/2026 |

| 9 Month Fixed Saver (Annual interest) | 3.68% | 3.70% | 25/02/2026 |

| 9 Month Fixed Saver (Monthly interest) | 3.64% | 3.70% | 25/02/2026 |

| 1 Year Fixed Saver (Annual interest) | 3.90% | 3.90% | 25/02/2026 |

| 1 Year Fixed Saver (Monthly interest) | 3.83% | 3.90% | 25/02/2026 |

| 2 Year Fixed Saver (Annual interest) | 4.05% | 4.05% | 11/02/2026 |

| 2 Year Fixed Saver (Monthly interest) | 3.98% | 4.05% | 11/02/2026 |

| 3 Year Fixed Saver (Annual interest) | 4.11% | 4.11% | 07/01/2026 |

| 3 Year Fixed Saver (Monthly interest) | 4.03% | 4.11% | 07/01/2026 |

| 5 Year Fixed Saver (Annual interest) | 4.15% | 4.15% | 22/10/2025 |

| 5 Year Fixed Saver (Monthly interest) | 4.07% | 4.15% | 22/10/2025 |

These rates are effective from the date shown above and are fixed until the end of your product term.

You will earn interest on the money in your Fixed Saver from the day you pay it into the account. We calculate interest on your balance daily using the gross interest rate. For monthly interest products, we typically pay interest on the day of the month your account was opened. For annual interest products with a term of 1 year or longer, we pay interest on the anniversary of account opening. For products with a term of less than 1 year, we pay interest at the end of the term.

You can choose to have interest earned added to your Fixed Saver or paid into a nominated account in your name.

‘AER’ means ‘annual equivalent rate’ and is designed to make it easy for you to compare savings products. It tells you how much interest you’d earn if you put some money in an account and left it there for a full year. It takes account of things like how often the interest is paid and assumes any interest paid during that year is added to the balance and earns interest.

‘Gross’ is the interest rate paid on an account before any taxes or other deductions are accounted for.

Fixed Rate Saver Summary Box_v4.1. (Effective from 01/09/2025) - Rates effective from the date shown in the table above.

Got a question?

Check out our most popular Fixed Saver Frequently Asked Questions below, or kick back and read our Fixed Saver T&Cs.

If you want to find out more about Atom bank, head to our FAQs page.

To speak to a member of our team, jump into the app - they're here everyday, 8am to 8pm, ready to help.

Things to remember

Easy to fund

Pay money into your account from your Instant Saver or Instant Saver Reward account, or by electronic transfer from another bank or building society.

FSCS protected

At Atom, your savings are covered by the FSCS up to a total value of £120,000 across all your accounts. You can learn more about how your money is in safe hands here.

We'll keep you updated

View your transactions in real-time, know exactly when your statements are ready and forget faffy paperwork — everything’s in the app.

No cooling off period

Once you've added money to a Fixed Saver, you can't change your mind.

One week deposit window

Once your fixed term savings account is open you've got until 9pm on the same day of the following week to add your funds.

Open as many as you like

You can save up to £100,000 in total across as many Fixed Savers as you like with us, as long as you deposit a minimum of £50 in each one.

Maximum Balance Limit

You can hold as many Fixed Saver accounts as you like, as long as the total balance held in all your Atom Fixed Saver accounts doesn't exceed the Maximum Balance Limit of £100,000.

Browse and compare savings accounts

You can compare savings accounts and rates across our range of products below.

Instant Saver

Need an account with excellent flexibility? Our Instant Saver is an easy access account that gives you 24/7 access to your funds to add or withdraw whenever you want.

Instant Saver Reward

Grab a Reward rate when you don’t withdraw your money with this easy access account. If you do withdraw, you’ll get a lower interest rate for the current monthly period — but it bounces back to the Reward rate at the start of the next one.

Cash ISA

Secure tax-free growth for your savings with our Easy Access Cash ISA. You can save up to your annual ISA allowance and the interest you earn is completely free from UK Income Tax. It’s a simple way to get the most out of your money.