17-09-2025

9 min read

Atom bank study reveals EPC flaws holding back UK net-zero ambitions

- Trial led by Atom bank reveals that UK banks are likely over-reporting the emissions from their residential mortgage lending by as much as 50%, meaning the cost and time required to reach net zero could be halved

- The study found that the difference between carbon emissions from the most energy efficient properties and the least energy efficient properties is significantly less than predicted by EPCs

- The findings bring into question the usefulness of EPCs for eradicating fuel poverty and driving net zero, and should raise concerns amongst policy makers

- Industry group B4NZ is working with Atom bank and its other members from across the UK’s banks, asking them to share their own data and work with policymakers to improve the UK’s approach to net zero

- Atom is also calling on the Government to accelerate EPC reforms and to focus on providing low carbon, low cost power and heat to all

Atom bank has today published the results from a trial in collaboration with Experian which reveals that both Atom and the wider banking industry are likely over-reporting the emissions linked to residential mortgage lending by as much as 50%.

The results call into question the reliability of EPCs to estimate carbon emissions from all banks’ mortgage lending, with meter readings in the study showing both lower emissions and minimal variations in emissions between properties of very different EPC ratings.

Results from the trial

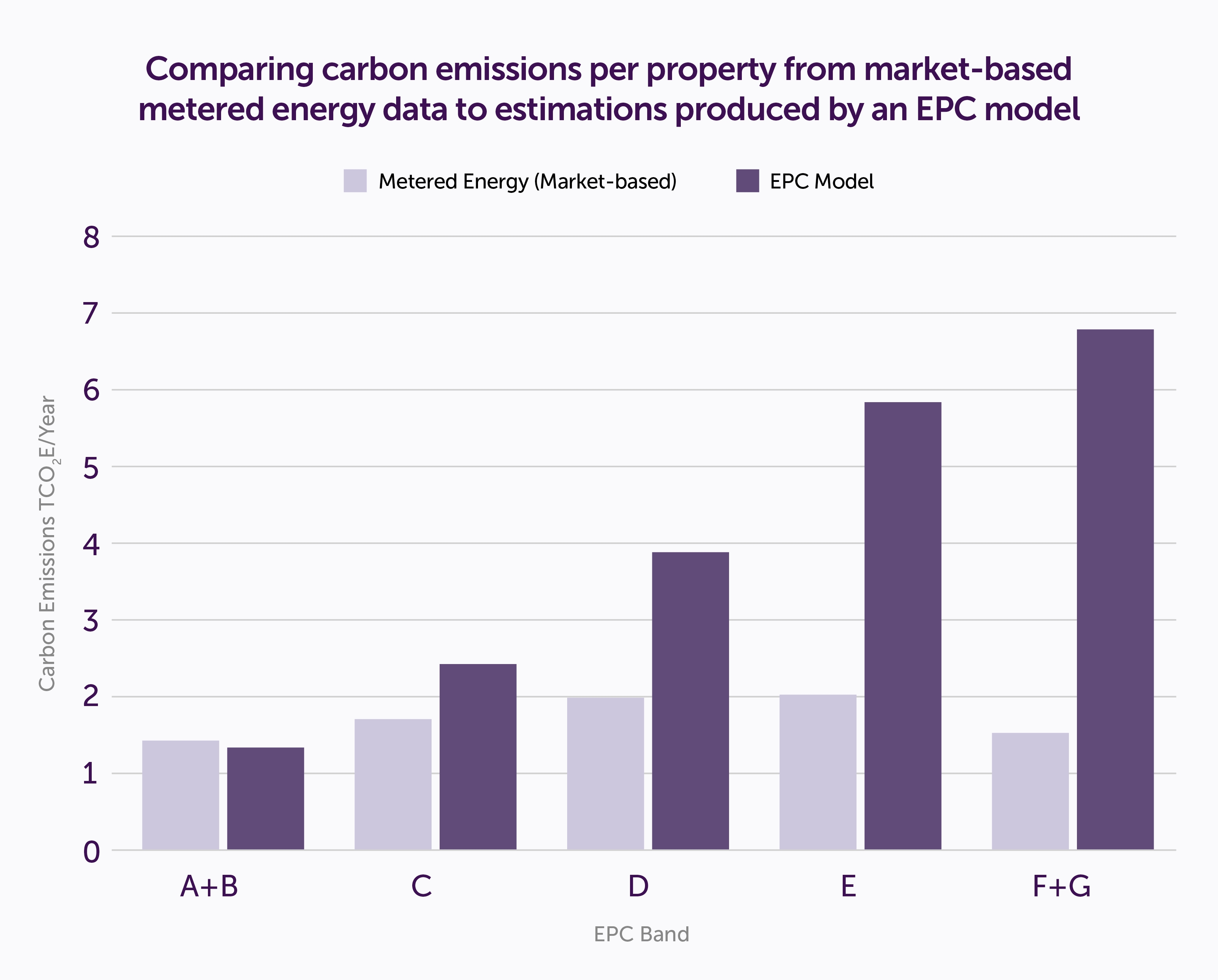

The trial compared estimates of CO2 emissions from 1038 homes based on their EPC rating with measurements derived from actual meter readings from these same homes.

Atom worked with the Department of Mathematical Sciences at Durham University to create and analyse a representative sample of homes from its mortgage book so that the trial would give a fair view of the broad range of houses that its customers are living in.

Experian’s assessment of the actual meter readings compared to the EPC estimates revealed that Atom is over-estimating the CO2 emissions from its residential mortgages by up to 50%. Experian and Atom believe that this huge difference is likely to be the same for many other banks and businesses who rely on EPCs to measure CO2.

Significantly, the study also shows that actual carbon emissions from properties in EPC bands A-C, regarded as the most energy efficient, are not significantly lower than for properties in EPC bands D-G. Initially, Atom assumed this was due to personal choices by its mortgage customers.

However, experts at University College London’s (UCL) Energy Institute observed a similar pattern across a larger national dataset - finding little variation in primary energy use above EPC band C, even after accounting for factors such as family size and thermostat temperature. The UCL team has subsequently been working to identify causes of discrepancies as part of a government study into EPC accuracy, but this has not yet been published.

Accelerating the journey to net zero

Atom is committed to its aim of being climate positive by 2035, but truly accurate data is crucial for it and the UK’s broader net zero ambitions. Atom is therefore calling on the energy suppliers, Government and the financial services industry to collaborate on EPC reform and to improve the accuracy of housing-related carbon data. Crucially, if this data is correct then the Government and banks should step up funding available for the generation and use of low-carbon electricity whilst also making electricity prices more competitive compared to gas for heating.

- Clarifying lenders’ roles in the route to net zero

As a first step, Atom, Experian and B4NZ are urging the energy providers, other banks, central Government and the Bank of England to share their data, enabling the industry and Government to gain a clearer understanding of actual emissions and the true cost of the transition to net zero. This greater transparency could enable financial institutions to focus efforts on areas where emissions reductions will have the most impact, contributing more effectively to the UK’s net zero ambitions.

- Spurring EPC reform

Atom is also calling on the Government to accelerate proposed EPC reforms, including shifting from estimated to actual energy performance data, such as from utility bills or smart meters. Accurate EPCs and more rigorous assessments of build quality are essential to ensure homes meet their energy performance claims, and are key in decision-making by home owners, social housing providers and the finance industry.

Using real energy data will enable low-income households and policy makers to identify the actual costs of running a home, creating a better basis for improving housing energy efficiency, and to more effectively target and address issues such as fuel poverty.

- Shifting to zero carbon sources of electricity

With a growing proportion of mortgages going to first-time buyers and new builds, there is a clear opportunity to align lending with the UK’s net zero ambitions. It is critical that banks reflect on their strategies to ensure they finance genuine low-carbon initiatives and schemes that can reverse the man-made effects of global warming.

Integrating meter data rather than theoretical models of carbon into their mortgages and other loan products has the potential to unlock a much more targeted approach to green lending that will help accelerate progress to a net zero future. But this will only have wide adoption when low carbon electricity is a genuinely competitive alternative to gas for heating. Government should continue to accelerate the transition to zero carbon electricity and to reducing costs to consumers.

Edward Twiddy, Atom’s Director of ESG, commented on the reasons for revealing these findings: “The UK has made real progress in addressing the challenge of decarbonising its economy but continuing that momentum will require better data and more targeted action. This study reveals that EPC ratings do not reliably reflect actual household emissions, with inaccurate data being a clear hindrance to reaching net zero. If most households are using similar amounts of energy, the focus should be on where that energy comes from and then how to make that clean energy as affordable as possible.

“The findings of this trial have important implications for green lending, banks’ carbon reporting, and the future use of EPCs in measuring and reducing residential emissions, which has implications for social issues like fuel poverty. Atom is collaborating with organisations such as B4NZ to engage with other banks and policymakers on the reforms needed to drive meaningful change. As the lenders of billions of pounds to households and businesses, banks like Atom have an enormous role to play in meeting the UK’s net zero commitments.”

Scott Harrison, Director of Strategy & Innovation, Business Information at Experian, said: “Collaborating with Atom on this study has reinforced what we at Experian have long understood — EPCs are not a sufficiently accurate way of measuring household carbon emissions.”

“This trial highlights the urgent need to shift from theoretical estimates to real-world data. By leveraging actual primary energy consumption through solutions like Experian Meter Insights, lenders can move beyond unreliable proxies and take meaningful steps toward emissions transparency, credible reporting, and real climate impact.”

Hannah Cool, COO, B4NZ, said: “Atom bank’s decision to publish these findings sets a powerful precedent for the financial sector. Transparency is essential if we are to accelerate the transition to net zero in a cost-effective and fair way. By acknowledging the limitations of EPC-based reporting and embracing more accurate, verifiable data, Atom is demonstrating real leadership. This also opens up the opportunity to move towards consented data sharing in a frictionless way, empowering consumers while enabling lenders to make smarter, greener decisions.

“We encourage other banks to join this initiative. Only through collaboration and open data can we reform outdated methodologies and ensure that sustainable finance is built on evidence, not assumptions.”

ENDS

Notes to Editors

For Atom Robbie Steel, robbie.steel@atombank.co.uk 07943784375

About Atom bank

Atom bank is a savings bank and mortgage lender, and is on a mission to make the experience of borrowing and saving faster, simpler and better value than anyone else. The bank launched operations in April 2016 as the UK’s first app-based bank, and offers award-winning mortgages and savings through its app, alongside secured business lending for small and medium-sized enterprises.

Based in the North East of England with a team of over 550 people, Atom is here to change banking for the good, for the better, and for everyone. This means focusing on customers’ needs, delivering better value than the incumbents, providing an exceptional app-based experience and offering award-winning customer support via phone, chat, email and social channels. The bank has some of the best customer service credentials in the UK, having achieved 5-star ratings on both the iOS and Android App Stores, and on Trustpilot, whilst consistently delivering Net Promoter Scores (NPS) in the high 80s.

Based in Durham, Atom is an engaged and active member of the North East Community. In 2022 Atom signed a five-year Memorandum of Understanding with Durham University to progress key research and diversity initiatives. The region has one of the highest levels of youth unemployment in the UK and Atom is passionate about addressing the critical digital skills gap and helping develop young people and other groups that are under-represented within the industry. In 2024, Atom purchased 25 acres of newly planted broadleaf woodland in Northumberland to sequester 7000 tonnes of carbon, which will account for all its operational emissions since founding. This forms part of the bank’s pledge to be climate positive by 2035, becoming the first UK bank to make this commitment.

As of November 2021, all employees enjoy a four-day working week, after Atom became the largest company - and only bank - in Britain to introduce the policy for all employees, with no reduction in salary. The Atom executive team are highly experienced, having built and run some of the most well-respected banks in the UK. CEO Mark Mullen has 30 years’ experience in the sector and was previously CEO at the multi- award-winning telephone and internet bank first direct. The team is supported by a strong non-exec board, chaired by Lee Rochford.