Introducing our NEW

Easy Access

CASH ISA

Earn 4.25% AER (4.17% tax free) variable*

*‘AER’ stands for Annual Equivalent Rate. This shows you what the rate would be if interest were paid and compounded each year. The rate is variable so may go up or down. Tax free means you won’t pay UK Income Tax on the interest you earn from this account.

ISA rules, T&Cs and eligibility apply. Must be 18+ and a UK resident. New deposits only, transfers in from other ISA providers are not accepted.

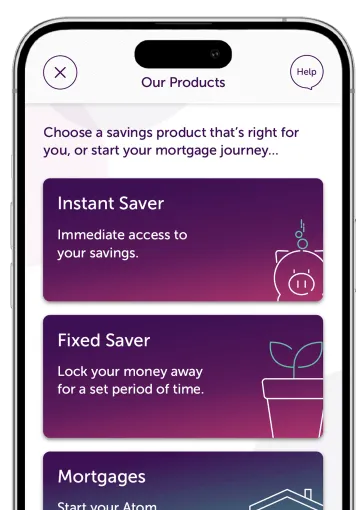

Meet our simple and speedy products

Are you saving, buying a home or growing your business? We’ve got what you’re looking for. Our products are a breeze to open and incredibly easy to use. Plus, we don’t fork out on expensive branches, so we can deliver better rates for you.

Savings

Explore our savings rangeSave up to 4.25%

with our savings products Whether you need easy access to your money with a Cash ISA, Instant Saver, Instant Saver Reward, or you’re in it for the long haul with a Fixed Saver, you’ll find an account to suit your needs.

Mortgages

Explore our mortgage rangeFast, uncomplicated and competitive mortgages

We offer simple mortgages that provide competitive value through our network of independent brokers. Once your application is in, you can easily track it every step of the way in our app.

Commercial mortgages

Explore our business loansFixed and variable rate commercial mortgages up to 75% LTV

We’re supporting UK SMEs to grow with our business loan products. Our range includes fixed and variable business loans, as well as loans offered through the Growth Guarantee Scheme (GGS).

Why Atom?

We are the UK’s first app-based, digital bank and we are here to make banking easier, faster and better value with our products, services and in-app experience.

Savings and lending products that just work

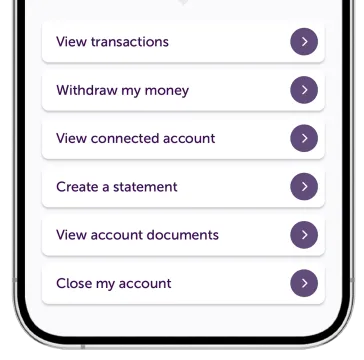

An app to make life easier

Keeping you safe and secure

We’re changing banking for good

Just like other banks, we’re regulated by the FCA, PRA and have FSCS protection. However, we’re here to make banking easier, faster and better value through our products and in-app experience. Plus, it's all supported by our award-winning customer support team - real humans just a phone call away.

Discover how we’re changing things for our customers.

Our story

Atom was founded in 2014 to make things better by offering customers better and fairer banking. We were awarded our banking licence in 2015, then officially launched in 2016. We’ve gone from strength to strength since, growing to a large team of talented people headquartered in sunny Newcastle. Our app-based savings accounts and mortgages have helped thousands of customers achieve their financial goals, which has led to us being named as one of the top banks on Trustpilot.

Read the full Atom storyWhat do our customers say?

Read the live, unfiltered reviews from our customers