15-12-2025

4 min read

Jingle bills: how unplanned spending is draining our savings

Team Atom

As the festive season approaches, we know that many can feel the pinch with their finances. Here at Atom, our new research has pulled back the curtain on UK Christmas spending habits, revealing a significant gap between good intentions and seasonal reality. We found that festive financial pressures push many off-track, leading to unexpected debt and an impact on long-term savings.

An unplanned Christmas

Our study shows that while many are disciplined with their money, a substantial portion of the population is entering the festive season without any plan on how they will pay for it.

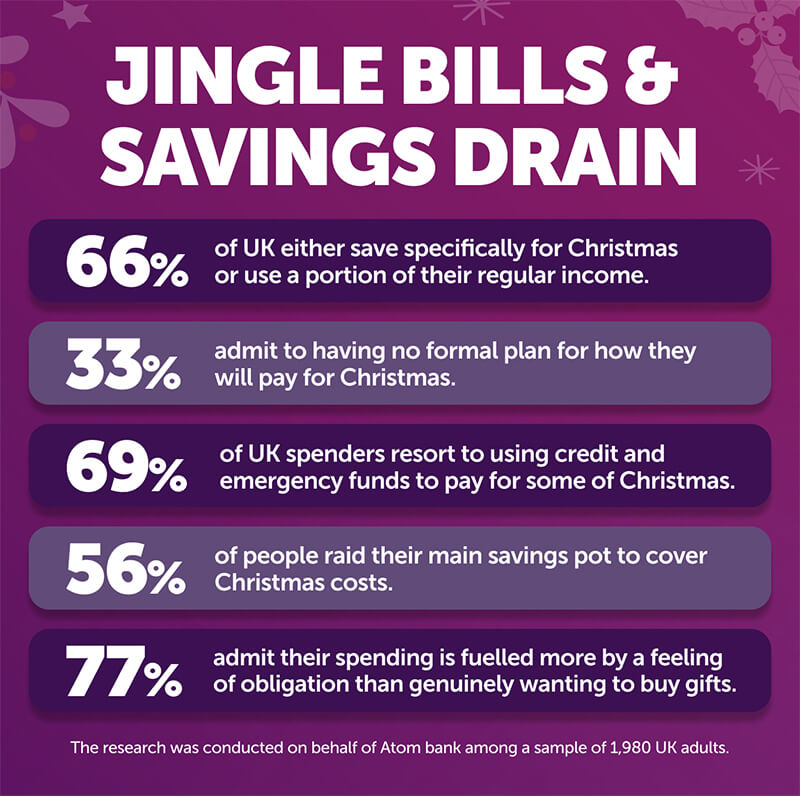

- Saving vs. spending: two-thirds of the UK (66%) either save specifically for Christmas or use a portion of their regular income. However, a third (33%) admit to having no formal plan in the run up, relying on covering costs as they arise or resorting to borrowing and dipping into investments.

The ‘unplanned’ factor and why we overspend

The research showed that one of the biggest struggles facing the nation is unforeseen Christmas costs. Nearly half of everyone we spoke to (48%) reported that ‘about half’ or ‘most’ of their Christmas spending is unplanned, despite the majority of us saving for Christmas throughout the year, highlighting the financial shock the season can deliver.

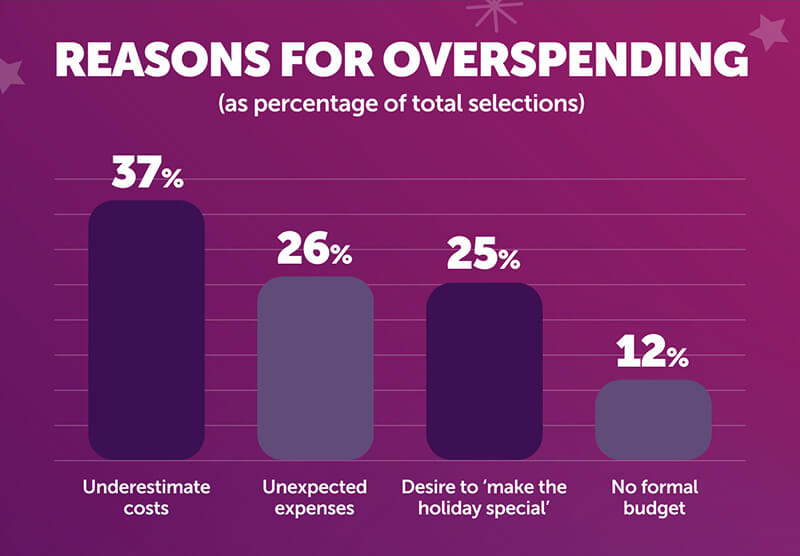

So, why do we exceed our intended budget?

That urge to ‘make the holiday special’ is a powerful emotional driver, and a major reason for overspending. This, combined with a tendency to underestimate the sheer volume of costs, is what fuels the Christmas spending crunch.

The consequences: dipping into savings and leaning on credit

When the festive bill arrives, what’s the first line of defence?

- Credit reliance is high: An overall majority of UK spenders (69%) resort to using credit and emergency funds to close the spending gap. This combined total comes from those using an existing credit card (37%), buy now, pay later schemes (19%) and dipping into an emergency fund (12%).

- Main savings hit: However, turning to a main savings pot remains a popular source of funding, with over half of us (56%) raiding this to cover Christmas costs.

A Christmas obligation

The emotional element of Christmas spending is powerful and clearly a major driver for spending above our limits. This is reflected in the motivation behind gift-buying. Whilst around a third (32%) of us willingly buy gifts because we genuinely want to, a considerable majority of us (77%) admit that our spending is often fueled more by a feeling of obligation.

Expert tips: start saving for next Christmas today

Aileen Robertson, Head of Savings at Atom, shares her top tips for ensuring next Christmas is stress-free and debt-free:

“The data is a wake-up call, showing the emotional pressure to spend and the very real consequence of people dipping into savings or taking on debt. But it doesn’t always have to be this way. The solution can be simple with some consistency and commitment throughout the year.”

- Work backwards, not forwards: “Don’t guess a savings goal — calculate it. Write down your total spend from last Christmas, including those unexpected costs, divide that by 12, and you have your monthly savings target for next year. Start now to make the monthly amount manageable.”

- Make it automatic: “Treat your Christmas fund like a bill. Set up a standing order to move the amount you need into a dedicated savings account on payday. If you don’t see the money in your main current account, you won’t be tempted to spend it.”

- Maximise your savings: “A dedicated savings account is a proven strategy for managing Christmas costs, not only keeping funds separate but also maximising growth. In fact, 85% of those we spoke to agreed this is an effective solution.

- Focus on connection, not cost: “Instead of giving into the obligation to overspend, reframe your focus to a more personal homemade gift or thoughtful experience rather than the monetary cost of the gift. Where possible have conversations with those who you feel an obligation to buy gifts for, you could suggest starting a new tradition of a shared experience instead of exchanging presents.”

Start your 2026 Christmas savings journey today and head over to our savings page now and see how much your money could grow with Atom!

Research conducted on behalf of Atom Bank in November 2025 among a sample of 1,980 UK adults (UserTesting).