Easy Access Cash ISA

A simple, secure way to maximise your savings.

An Easy Access Cash ISA lets you grow your money without paying tax on the interest you earn.

4.25% AER variable

4.17% tax free variable

Earn savings interest without paying Income Tax

Add up to £20,000 this tax year (ISA transfers in not available - we're working on it)

Great for long and short term savings with easy access when you need it

What is a Cash ISA?

An ISA, or Individual Savings Account, is a type of account that allows you to earn interest tax free. This means you don’t pay UK Income Tax on the interest you receive.

A cash ISA is a type of ISA where you can deposit cash and benefit from tax-free savings interest. This lets you maximise the earnings from your cash savings and reach your savings milestones more efficiently.

How does an Atom Easy Access Cash ISA work?

Each tax year, you can deposit your ISA allowance across your ISA accounts. This annual allowance is set by the UK Government and is currently £20,000. If you open an Atom Cash ISA, you can put the whole allowance in, or you can split it across your Atom Cash ISA and ISAs with other providers.

Our Cash ISA is easy access so you can make deposits up to your annual ISA allowance and unlimited withdrawals at any time. It’s important to know that it’s not a flexible ISA, which means that if you withdraw money, you can’t replace it without using more of your ISA allowance for the year.

Currently, we do not accept transfers in from other ISAs but we’re working on it. You can however transfer money from your Atom Cash ISA to another provider, but you must move the full balance.

What’s the Easy Access Cash ISA rate?

Easy Access Cash ISA

Monthly interestTax free*

4.17%

AER**

4.25%

Earns You£42.50per annum

* Tax free means you won’t pay UK Income Tax on the interest you earn from this account.

** AER’ means ‘annual equivalent rate’ and is designed to make it easy for you to compare savings products. It tells you how much interest you’d earn if you put some money in an account and left it there for a full year. It takes account of things like how often the interest is paid and assumes any interest paid during that year is added to the balance and earns interest.

View our archived ratesWhy open an Atom Easy Access Cash ISA?

Maximise tax-free earnings

Save up to £20,000 this tax year, and maximise the interest you earn.

Great for long term savings

The interest you earn in a cash ISA will be tax free for the life of the ISA.

Unlimited easy access

Add or withdraw funds whenever you need to. Remember: our Cash ISA is not flexible.

Simple, no fuss ISA savings

There are no introductory rates, penalties or fees, so you can focus on reaching your goals.

Get set up in minutes with £0

Download our app, open your Atom ISA account and start saving in just a few taps. No minimum deposit necessary.

Your money is protected

Any money you save with Atom, including your Cash ISA, is covered by the Financial Services Compensation Scheme (FSCS) up to a total value of £120,000.

Here’s what you need to know

The rate is variable

This means it can go up and down at any time.

You can deposit up to your annual £20,000 ISA allowance

This allowance applies across all ISA providers for the current tax year. Our current allowance resets annually on April 6th at the start of the new tax year. It is set by the UK Government and is subject to change.

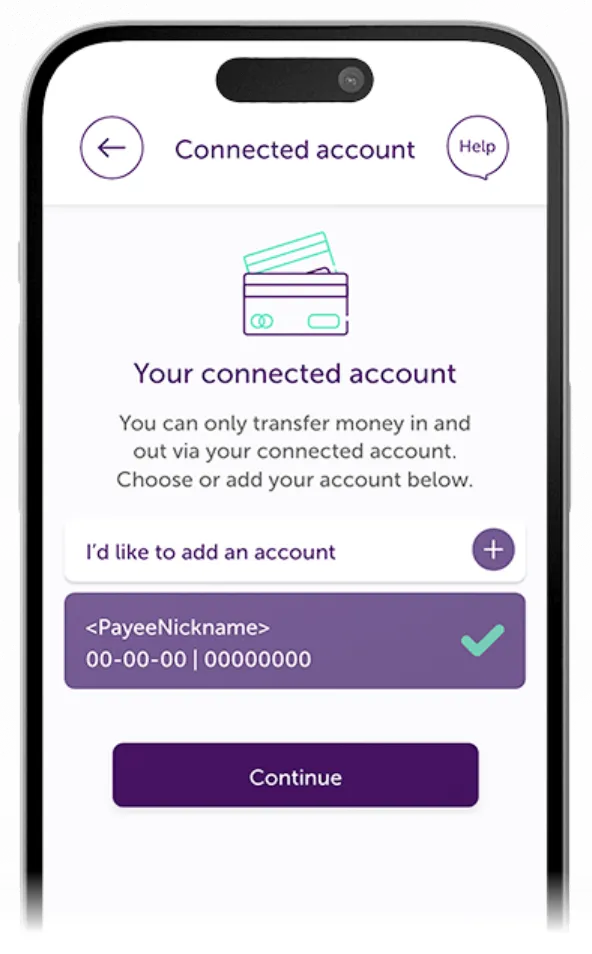

You can only add money from a connected account

You can only add funds from the UK current account that is your connected account. You can’t fund your Atom Cash ISA via an ISA transfer from another provider at the moment.

This is not a flexible ISA

Once you withdraw money, you can't put it back in without using up more of your annual ISA allowance.

You can’t track your allowance with other banks

You can track how much of your ISA allowance you’ve used with Atom in the app, but if you have ISAs with other providers, you need to track those balances yourself.

You can transfer your ISA to another provider at any time

You can move money in your Easy Access Cash ISA to another ISA via an ISA transfer but you must move the full balance. If you transfer it to an account that isn’t an ISA, it will no longer earn interest tax free.

FSCS Protection

What's this all about? Well, in a nutshell your money will be covered by the Financial Services Compensation Scheme (FSCS), which means your deposits are protected up to £120,000 should anything happen to the bank.

How do I apply for an Easy Access Cash ISA?

To apply for our Easy Access Cash ISA, you'll need to be 18 or over and a UK resident. ISA rules, T&Cs, and eligibility criteria apply.

The interest rates shown in these images are examples only and may not reflect our current rates.

Easy Access Cash ISA Summary Box

Account name: Easy Access Cash ISA

| Interest | Rates |

|---|---|

| AER | 4.25% (variable) |

| Tax free per annum | 4.17% (variable) |

- These rates are effective from 03/12/2025.

- You will earn interest on the money in your Easy Access Cash ISA from the day you pay it into the account. We calculate interest on your balance daily using the tax-free rate and add it to your account once a month, usually on the same date your account was opened.

- ‘AER’ means ‘annual equivalent rate’ and is designed to make it easy for you to compare savings products. It tells you how much interest you’d earn if you put some money in an account and left it there for a full year. It takes account of things like how often the interest is paid and assumes any interest paid during that year is added to the balance and earns interest.

- ‘Tax free’ means the rate of interest paid where interest is exempt from income tax.

Easy Access Cash ISA Summary Box_v1.1. Effective from 05/11/25. (Rates effective from 03/12/2025).

Discover our other savings accounts

Here are some of the other accounts available in our range.

Instant Saver

Our Instant Saver is an easy access savings account that gives you ultimate flexibility with 24/7 access to your money.

Instant Saver Reward

Earn a Reward rate with this easy access account when you don't make withdrawals. If you do withdraw, a lower interest rate will apply for that monthly period, reverting to the Reward rate at the start of the next monthly interest period.

Fixed Saver

Secure a fixed interest rate with our Fixed Saver. Select a term between 6 months and 5 years and see your savings increase. Perfect if you have a lump sum you won't need immediate access to.

Want to know more?

Here are our Cash ISA FAQs. You can also download our Easy Access Cash ISA Key Features sheet and read the T&Cs here.

If you want to find out more about Atom bank, head to our FAQs page.

To speak to a member of our team, jump into the app - they're here everyday, 8am to 8pm, ready to help.