22-12-2025

6 min read

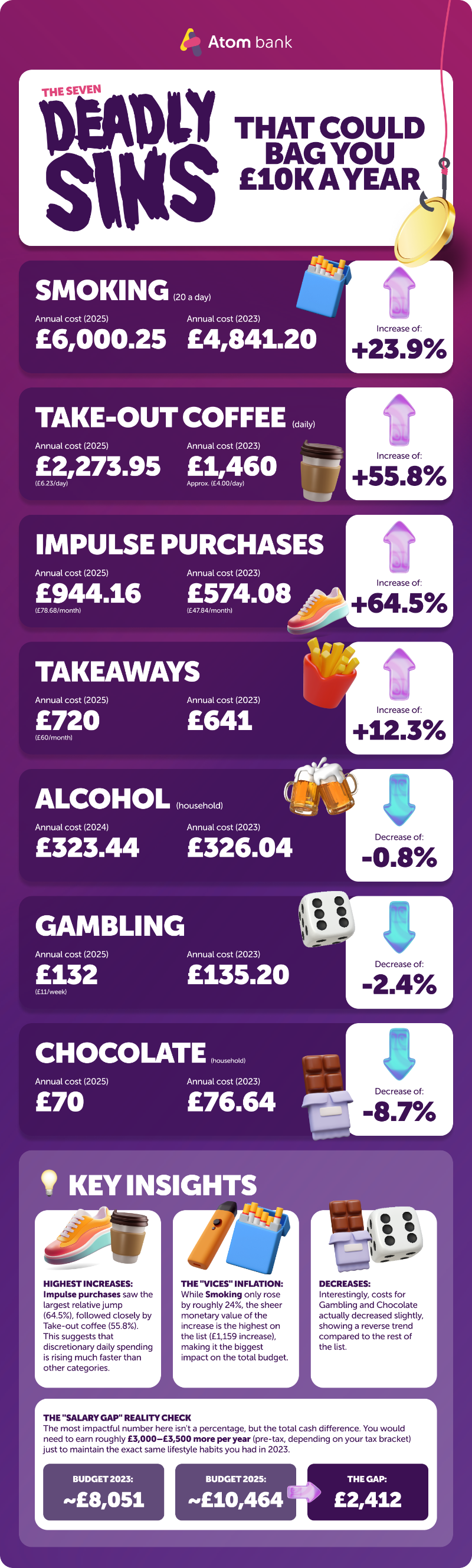

Brits could save £10k a year by ditching these seven vices at New Year

Team Atom

With 2026 just around the corner, it’s nearly time to make those New Year’s resolutions. And let’s be honest: while the goal is often a healthier lifestyle, the potential boost to your bank balance is also a huge motivator. Cutting out things like smoking, daily takeaways or a few pints a week can quickly add up to a significant savings pot.

We’ve identified seven vices that could be worth giving up and added up the cost based on 2025 data. By leaving them behind in 2025, you could save a staggering £10,000 over the course of the next year.

So why not make 2026 the year to truly commit to a healthier, and wealthier, you?

How does it compare to 2023?

It was back in 2023, when we first crunched the numbers. Of course, a lot has changed since then. Costs have soared, and what you save today might be dramatically different to three years ago.

This year, we’ve updated the annual costs for popular vices to show you the massive savings potential, as well as comparing the new costs to see how much more (or less!) you could be pocketing compared to three years ago.

The difference between the combined totals is eye-opening: in 2023, we were spending £8051.56 on these seven vices, compared to £10,463.80 in our 2025 check in. That’s an increase of £2412.24 in just a few years.

So, here is a breakdown of the seven vices and their updated annual costs, revealing how much you could save this year by ditching the habits and banking the balance.

Want to see a summary of our findings? Check out the infographic at the end of this blog post.

Smoking

£6,000.25 per year if you smoke 20 cigarettes a day (Ash Scotland)

Just over 1 in 10 people in the UK are smokers (ONS), the lowest in recorded history, so this pricey habit is becoming less popular. Needless to say, if you’re a smoker, you’ll be around £6,000 better off if you’re smoking 20 cigarettes a day and give them up in 2026.

2023 vs 2025: Smoking has been getting more expensive for a while now due to rising tax and duties on tobacco products. So, it’s little surprise that the annual average cost to buy 20 cigarettes a day has increased from £4,841.20 in 2023 (Stop Smoking Service — data no longer available).

Need some help? Go to the NHS to get assistance with quitting smoking.

Take-out coffee

£6.23 per day totalling £2,273.95 per year (Working From Coffee Shops)

Coffee is the most popular beverage in the UK (ITV) and 80% of us visit a coffee shop once a week (source). Let’s say you’re a hardcore coffee drinker and visit your favourite coffee shop every morning — you’d be looking at a bill of £2,273.95 for the year.

2023 vs 2025: While we’re using different sources, the data suggests that, on average, we’re spending more per visit to the coffee shop at £6.23 (2025) versus £4.00 (2023, Appinio). So either the coffee has gotten more expensive, or we’re grabbing more cake!

Need some help? The Barista has a great guide to making coffee at home.

Impulse purchases

£78.68 per person per month, totalling £944.16 per year (Vanquis)

In 2025, the average Brit is making £78.68 of impulse purchases each month according to a survey. While it’s perfectly fine to spend your money, not thinking about whether something is really needed before buying can be a major barrier to saving.

2023 vs 2025: The two pieces of research we’ve found suggest that impulse purchases are on the rise with £47.84 per month in 2023 (Whistl) compared to £78.68 in 2025.

Need some help? Read this article from the Guardian to get tips on how to curb your urge to splurge on impulse purchases.

Takeaways

£720 per year (The Mirror)

This year, a survey reported on by The Mirror found that the average person spent £60 a month on takeaways, equating to a grand total of £720 per year. Takeaways are a delicious treat, but one of the things that can be cut down on if you want to save cash.

2023 vs 2025: In 2023, we found KPMG figures reporting a yearly average spend of £641 per year. While the new survey is from a different source, a more recent KPMG report found that over a third (34%) of Brits were cutting back on takeaway spending. It may be that the increased figure is simply down to the rising cost of food in the last three years.

Need some help? BBC Food has lots of fakeaway recipes you can make at home.

Alcohol

£323.44 per year (GOV.UK)

Brits typically spend £323.44 on alcohol each year, according to the latest UK Government data (FYE 2024). That liquidity could be heading into your bank account rather than your glass if you make it a resolution this year.

2023 vs 2025: The data we used in 2023 is no longer available, but looking at the same GOV.UK data, we can see per person spending on alcohol was £326.04 in the 2022/23 financial year. This means spending remained around the same level.

Need some help? Drinkaware is a strong starting point.

Gambling

£132 per year (Finder)

If you’re a gambler, you could see your bank balance boosted by £11 a week if you skip a trip to the bookies, based on updated figures from Finder. Stick that in a savings account and you could bag £132 (plus interest!) in the coming year.

2023 vs 2025: Back in 2023, the average gambler was spending marginally more on having a flutter at £135.20 per year. We’ve more or less stayed at the same level since, but we’re keeping £3.20 on average in our pockets each year — every penny counts!

Need some help? BeGambleAware is a great resource for addressing your habit.

Chocolate

£70 per year (NimbleFins)

According to 2025 data, the average Brit spends £70 per year on chocolate (based on the average UK household of 2.4 people). If you can resist your sweet tooth, you could pocket a nice sum as a reward for your discipline.

2023 vs 2025: We’re using a different source here, but the data suggests that we’re spending less than 2023’s £76.64. While the difference isn’t huge, the gap widens when you consider £70 in 2025 was worth £66.61 before inflation (BoE).

Need some help? Try some of the ideas from the British Heart Foundation when you are looking to avoid the call of the chocolate.

What can you do with the money saved?

If you’re planning to give up some of these vices — well done! You’re taking a great first step towards being healthier and in better financial shape.

And, if you’re wondering what to do with the excess cash you’ve got as a result, you could use it to kickstart a new savings regime. You could even make putting money away for a rainy day a New Year’s resolution alongside giving up your vice.

You’re also in the right place if you’re looking to open a savings account. Our Instant Saver, Instant Saver Reward and Easy Access Cash ISA are all easy access accounts that allow you to make deposits at your own speed — useful for starting a savings habit.

Infographic: